NVIDIA’s buybacks do create shareholder value — just not in the dramatic, thesis-driving way some bulls think, nor in the self-destructive way critics like Michael Burry argue.

The repurchase program works because it:

- Offsets very large Stock-Based Compensation (SBC) issuance,

- Provides real share-count shrink,

- Adds ~1% EPS uplift versus a no-buyback world,

- And acts as downside liquidity support.

But the program is not the engine of NVIDIA’s stock performance.

The stock trades on AI data-center earnings, TSMC/HBM/CoWoS supply, hyperscaler capex, and macro positioning — not on the authorization size.

Michael Burry’s “no value created / owners’ earnings cut in half” narrative overstates dilution math, misreads RSU tax mechanics, and is directionally right only about two things:

- SBC is massive, and

- The AI cycle contains real bubble risk.

At today’s valuation, the buyback is a mild tailwind, not a core bull argument.

Executed too aggressively into an AI downturn, it becomes a destruction-of-capital minefield.

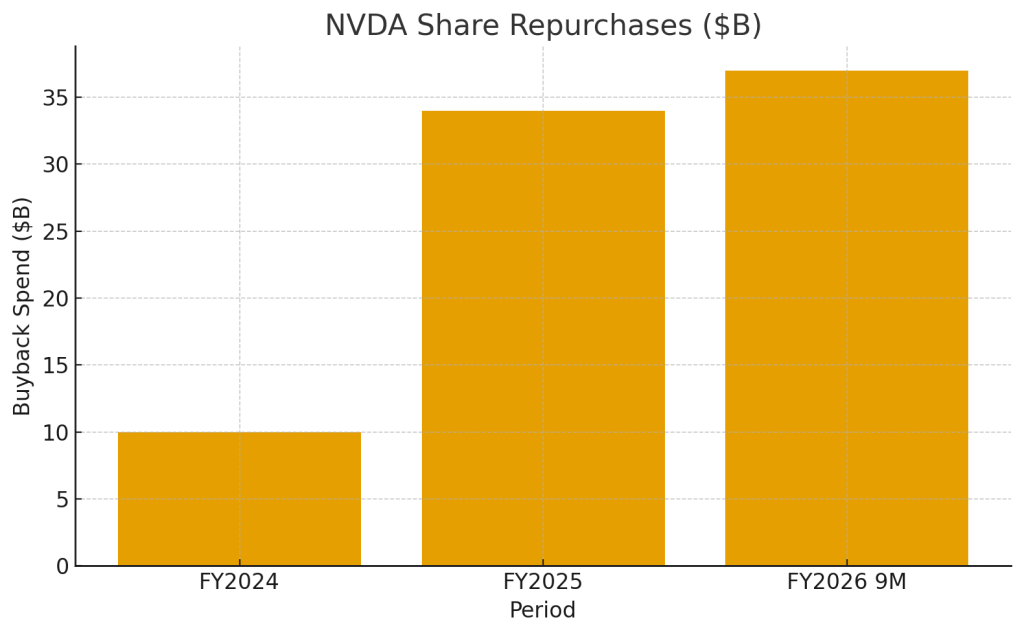

What NVIDIA Has Actually Done With Buybacks

Scale and Timing

NVIDIA has repurchased ~$90–110B of stock since 2018 — one of the largest programs in the world.

The shape of the curve:

Pre-AI Boom (Through FY2022)

- Only single-digit billions of lifetime buybacks.

- Program existed but was not central.

AI Super-Cycle Phase (FY2024–FY2026 YTD)

- FY2024: ~$9.7B repurchased (≈21M shares)

- FY2025: ~$34B repurchased (≈310M shares)

- Funded from ~$64B operating cash flow

- FY2026 YTD (first 9 months): ~$36–37B repurchased (≈262M shares)

- About $62B authorization still unused at Q3 FY26

- Total in FY25–FY26 YTD: ~570M shares retired for ~70B

In just two fiscal years, NVIDIA retired half a billion shares, dwarfing the entire pre-2023 program.

Share Count Trend

Despite enormous SBC, the diluted share count is slightly lower than in 2018 — down ~2% over seven years.

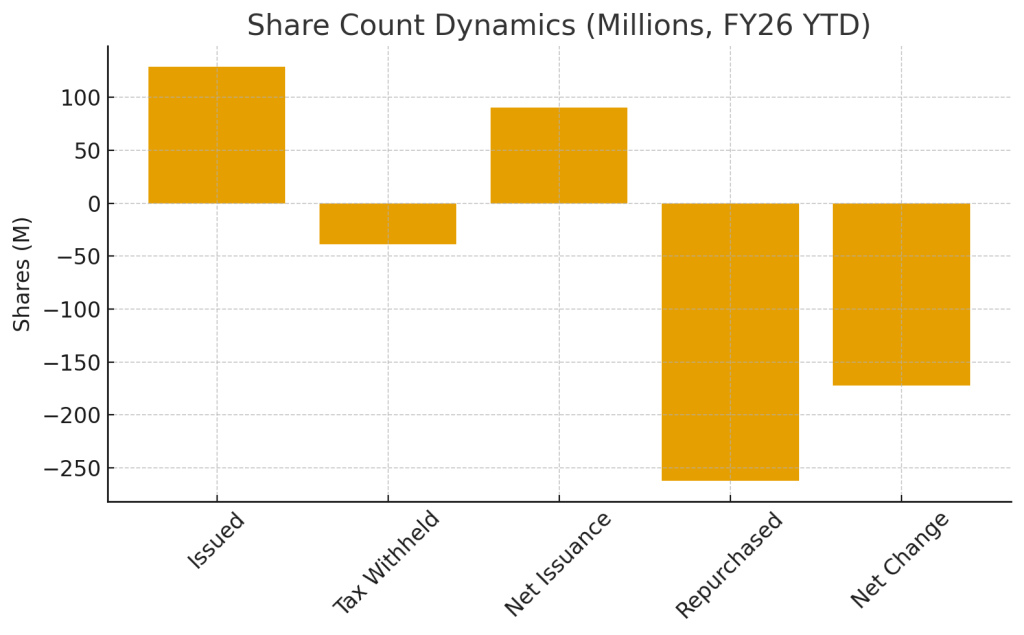

FY26 YTD breakdown:

- Shares issued: ~129M (SBC + acquisitions)

- RSU tax withholding: ~39M

- Net new shares: ~90M

- Shares repurchased: 262M

- Net reduction: ~172M shares (~0.7% share shrink in nine months)

This is real share reduction, far more than just anti-dilution maintenance.

This alone disproves Burry’s claim that share count is up “47M.”

It is actually down — not up.

EPS Accretion vs SBC: The Real Effect

FY26 year-to-date is the cleanest demonstration.

- GAAP Net Income: ~$77B

- Diluted Weighted-Average Shares: ~24.5B

- Reported EPS: ~$3.14

Now the scenarios:

| Scenario | EPS | Effect |

|---|---|---|

| Actual (full buybacks) | ~$3.14 | Baseline |

| Offset-only (repurchase only net issuance) | ~$3.12 | ~0.6% lower |

| No buybacks at all | ~$3.11 | ~1.0–1.2% lower |

Summary:

- Buybacks add ~1% EPS versus a no-buyback world.

- The “extra” beyond anti-dilution adds ~0.6%.

- The overwhelming majority of EPS growth comes from fundamentals (data-center wins, margins, scale).

But buybacks matter economically because:

- Repurchases dramatically exceed net issuance (262M vs ~90M).

- SBC is huge, but the buyback more than neutralizes it.

- Excess repurchases = real capital return.

In Buffett terms:

Buybacks above anti-dilution are owner earnings being returned.

Burry’s Critique vs Reality

Michael Burry argues:

- ~$205B cumulative net income since 2018

- ~$188B cumulative FCF

- ~$20.5B SBC

- ~$112.5B buybacks

- Share count up 47M → “buybacks create no value and only mask SBC”

Reality check:

Dollar Error

Actual buybacks since 2018 are closer to $90B — not $112.5B.

His figure appears to include RSU tax withholding.

Share Count Direction Error

Shares have shrunk, not increased.

The “+47M” claim flips the sign.

Economic Error

Average buyback price since 2018 is roughly $50 split-adjusted.

The stock now trades many multiples of that.

Those early repurchases are massively value-accretive ex-post.

Where Burry is right

- SBC is very large

- AI ecosystem has bubble behaviors

- Circular financing (NVDA investing in its own customers) is a real risk

- Depreciation timelines may prove optimistic

Where he overreaches

- Treats all buybacks as “SBC cost”

- Misreads share-count math

- Claims zero value created

The truth:

A large portion of NVIDIA’s cash generation has gone to employees,

but buybacks have still been mildly net-positive for continuing shareholders.

Do Buybacks Move the Stock?

Event Behavior

Patterns:

- Buybacks + blowout earnings = pop

- Buybacks + mixed fundamentals = no reaction

- Buybacks + China concerns = negative reaction

- Buybacks + AI overbuild fears = overshadowed

- Q3 FY26 blowout → stock reversed lower despite heavy repurchases

Conclusion: Fundamentals overpower the buyback headline.

Flow Mechanics

- Daily repurchase pace: ~1.1M shares

- Daily trading volume: 180–240M shares

- Mechanical impact: <1% of flow

Buybacks are a steady bid, not a stock mover.

Options and macro positioning swamp them.

Risks to Buybacks and Capital Allocation

The buyback only makes sense in the context of NVIDIA’s broader risk environment:

Valuation Risk

Stock trades at elevated multiples on peak-ish earnings.

If AI capex slows, the multiple compresses faster than repurchases can support.

Supply-Chain Commitments

Over $50B in non-cancellable HBM/CoWoS/TSMC commitments compete with buyback cash.

Geopolitical Risk

China export rules have already wiped out entire product lines.

New rules could repeat that.

Customer Concentration

Four hyperscaler/AI-cloud customers dominate AR and orders.

Any one of them pulling back = immediate earnings reset.

Circular Financing

NVIDIA invests in some of its own customers (OpenAI, CoreWeave).

Vendor-financed demand can unwind suddenly.

Competition

AMD, Intel, and hyperscaler ASICs eat into share from 2026 onward.

Buyback Tax Risk

1% excise tax negligible.

4% would materially reduce repurchase efficiency.

True Shareholder Value Created

From 2018 through today:

- $90–110B cumulative repurchases

- ~2% net share reduction despite huge SBC

- Early buybacks at ~$50 → massively accretive

- ~1% annual EPS accretion in FY24–FY26

- Real value came from earnings growth, not EPS engineering

Bottom line:

NVIDIA’s buybacks do create value —

but the company’s earnings explosion is what created the 10x stock move, not the buyback program.

Path Forward: What NVIDIA Should Do

Baseline – Programmatic Discipline

- Maintain steady 10b5-1 repurchases

- Primary objective: neutralize SBC

- Secondary: gentle share shrink

- Fund only after:

- Supply commitments (6–8 quarters)

- R&D and platform investments

- Liquidity buffers

Accelerate Only When

- Valuation dislocates on sentiment (not fundamentals)

- Large SBC vesting windows require offset

- Supply-chain prepayment needs get lighter

Slow or Pause When

- Export controls hit

- HBM/CoWoS commitments spike

- Large M&A or inventory write-downs occur

- Buyback tax hikes

This is what separates responsible capital allocation from top-tick destruction.

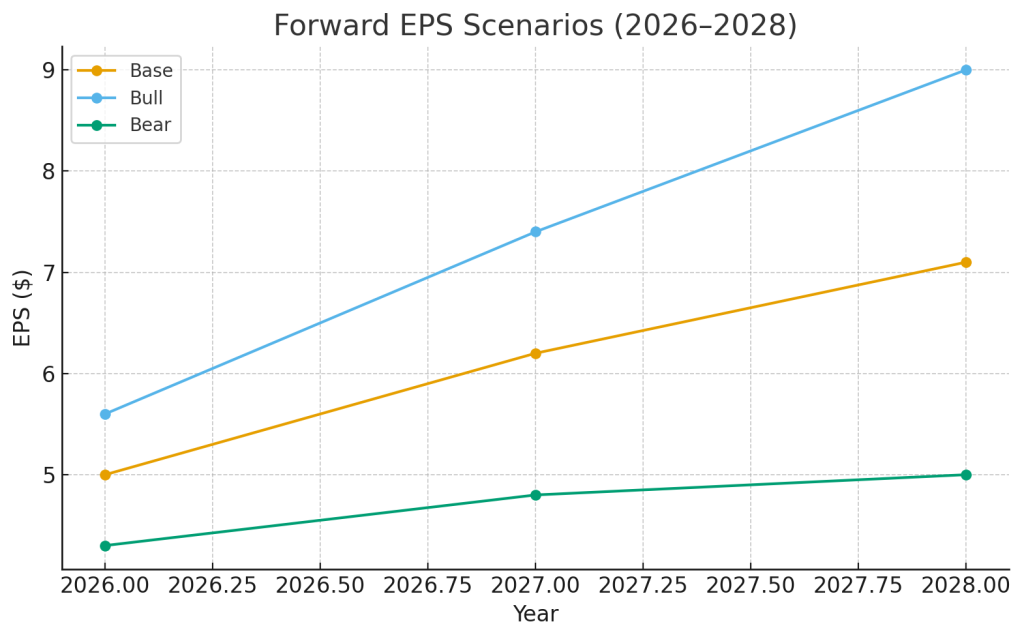

How to Frame NVDA Going Forward

Structural View (3–5 Years)

- The AI infrastructure build-out remains the backbone of the thesis

- CUDA + networking + ecosystem remains a substantial moat

- Even with competition, total demand can produce strong multi-year earnings

- Buybacks likely drive 1–2% share count shrink per year

Cyclical / Valuation View (12–24 Months)

- The risk is that the market has over-extrapolated AI demand

- Any capex pause, export shock, or margin compression triggers derating

- In that world, buybacks do not save the stock —

they merely cushion the descent

Blunt Take

NVIDIA is an AI infrastructure superpower — but the easy multiple expansion is done.

The buyback is supportive, not thesis-defining.

If you are going to own NVDA, own it for AI demand and competitive moats, not because of a $62B authorization.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Conduct your own due diligence and consult with a licensed financial advisor before making investment decisions.