At around $314 per share (~$3.8T market cap, ~24x forward P/E), Alphabet is being priced as a durable AI platform, not a cheap “value tech” name. The question is whether Gemini 3, TPUs, and Cloud can grow into that valuation without margins getting crushed by the capex bill.

My read: GOOGL is a high-quality AI compounder with a real moat and real cash flow, but now firmly in “execution and capital-discipline” territory. Upside is still attractive if AI monetization scales as planned; downside shows up if AI Mode erodes Search economics or if capex outruns revenue.

Q3 2025 Earnings Highlights

- First ever $100B+ quarter. Q3 2025 revenue cleared ~$102B, with Search + mid-teens %, YouTube ads +mid-teens, and Cloud +mid-30s %. Operating margin ex-fine was ~34%, Cloud margin ~24%, and Cloud operating income nearly doubled year-on-year.

- Gemini flywheel is real. Gemini app has roughly 650M monthly users, AI Mode in Search ~75M US daily users with queries doubling QoQ, and Alphabet now counts 300M+ paid subscribers across YouTube/other services.

- Full-stack AI moat. Custom TPUs, optical networking, Gemini 3 Pro, and global distribution across Search, Android, YouTube, and Workspace give Google an integrated stack peers can’t fully match.

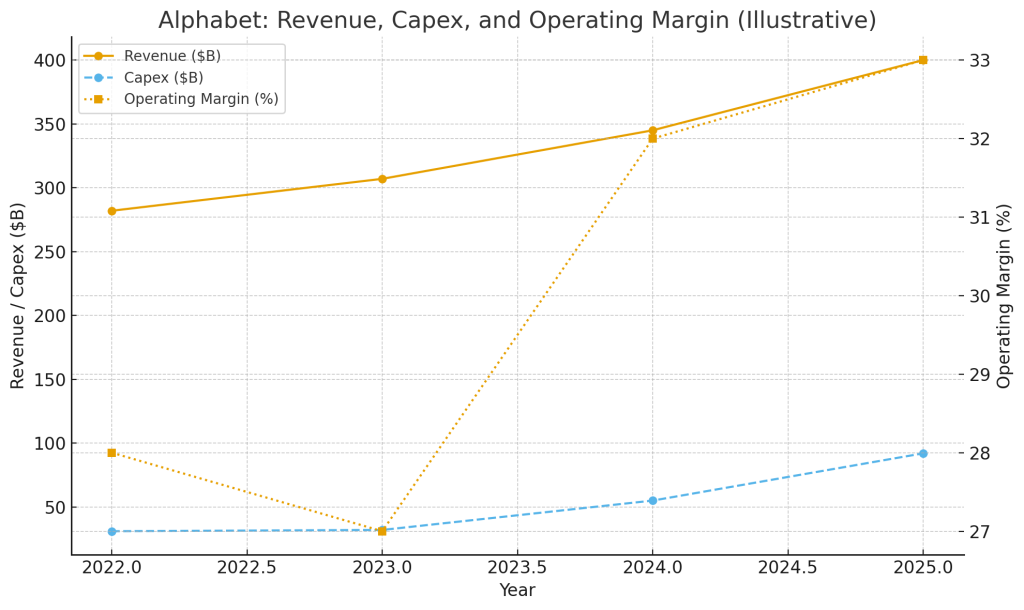

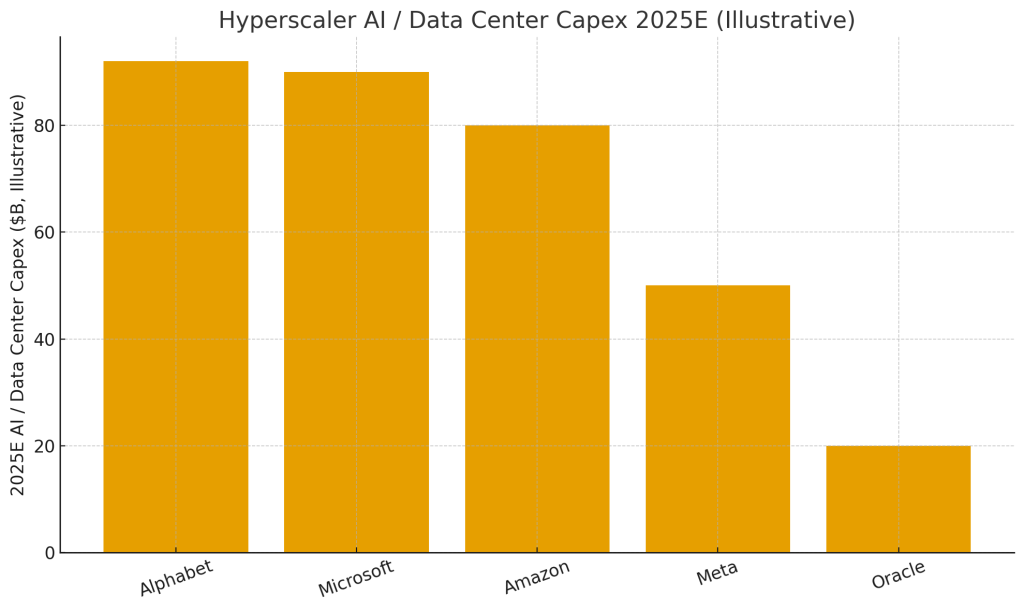

- But the bill is huge. 2025 capex guidance was raised to $91–93B with expectations of > $110B in 2026, making Alphabet one of the most capital-intensive companies on earth.

- Peers are all in too. Microsoft, Amazon, Meta, and Oracle are likewise ramping AI capex as investors increasingly question whether $400B+ annual hyperscaler spend in 2025 is fully justified by AI profits.

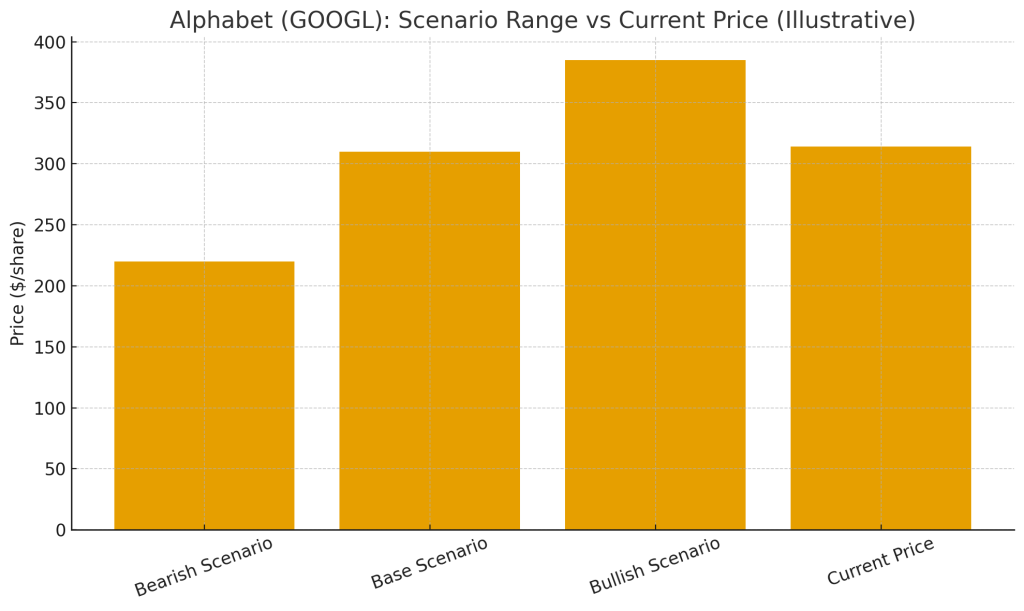

- Scenario targets (12–18 months):

- Bullish: $370–400 (high-teens revenue growth, mid-30s margins, strong Gemini monetization)

- Base/neutral: $295–325 (low-teens growth, low-30s margins, AI a solid but not explosive driver)

- Bearish: $205–235 (mid-single-digit ad growth, Cloud growth slowdown, capex squeeze and/or regulatory hit)

Strategic Position – Where Alphabet Wins (and Where It Doesn’t)

Core strengths

- Search & YouTube still throw off cash.

- Search and Other generated over half of Q3 revenue with mid-teens growth, helped by AI Mode and more transactional queries.

- YouTube ads grew mid-teens; Shorts now has billions of users, with monetization catching up to long-form and CTV continuing to gain share.

- Cloud momentum with AI leverage.

- Google Cloud revenue grew mid-30s %, with 23–24% operating margins and record operating income as AI workloads ramp.

- Remaining performance obligations (RPO) stand around $155–158B, with just over half expected to convert in the next 24 months, giving strong visibility into 2026–27 revenue.

- Gemini-anchored ecosystem.

- Alphabet now has one of the largest consumer AI footprints on earth: 650M+ Gemini MAUs, 75M DAUs in AI Mode, and rapidly growing Workspace/Vertex AI usage.

- Gemini is embedded into Search, the Gemini app, Android, YouTube, Chrome, Workspace, and Cloud APIs – not a bolt-on product.

- Full-stack AI economics.

- Google’s TPU platforms (v5e, v6e, v7 “Ironwood”) are increasingly described as meaningfully more cost- and energy-efficient than top-end GPUs for large-scale inference, with estimates of 60–65% lower energy use for search-like workloads.

- Owning silicon, data centers, and models lets Alphabet compress cost per token and control its own destiny instead of renting everything from Nvidia.

- Diversification beyond “just ads.”

- Cloud is now a large, profitable business.

- 300M+ paid subs across YouTube Premium/Music/TV and other services form a second recurring-revenue leg.

- Waymo is running ~hundreds of thousands of robotaxi rides per week across several U.S. metros, a small but symbolically important real-world AI business.

Weaknesses and risk factors

- Capital intensity & depreciation drag.

Capex of ~$90B+ in 2025 and potentially $110B+ in 2026 means depreciation will climb sharply. If AI revenue doesn’t ramp fast enough, consolidated margins compress even from today’s ~34% level. - Regulatory crosshairs.

Ongoing EU Digital Markets Act investigations into Search ranking and self-preferencing carry fine potential of up to 10% of global revenue, plus structural remedies that could dent Search economics or restrict data use. - AI cannibalization risk.

AI Mode and Overviews can, in theory, reduce traditional link clicks and advertiser ROI if not tuned carefully. So far ad monetization in AI Overviews is reported to be roughly in line with classic Search ads, but that’s early days. - Crowded AI narrative.

Hyperscalers collectively may spend ~$441B on AI-driven data centers in 2025, a 3x step-up from 2023; investors are now probing whether all that spend earns an adequate return.

Gemini 3 Pro – The New Center of Gravity

How Gemini 3 Pro is changing Alphabet’s ecosystem

- Search:

- Gemini 3 Pro now powers AI Mode in Search across ~120 countries for paying AI subscribers, replacing 2.x models and enabling more complex, multimodal, “agentic” answers.

- Google is experimenting with hand-offs from AI Overviews into AI Mode (“show more”), aiming to keep users inside conversational sessions where follow-up queries, shopping journeys, and ads stack up.

- Consumer apps:

- The standalone Gemini app (mobile + web) has become a front-door assistant layered on top of Gmail, Docs, Drive, Maps, and Photos.

- Gemini Nano runs on-device for Pixel and select Samsung phones, enabling offline summarization, transcription, and context-aware suggestions without sending everything to the cloud.

- Enterprise & Cloud:

- Gemini agents and tools sit inside Workspace (Docs, Sheets, Slides, Meet) as paid add-ons and in Vertex AI as APIs, with tens of thousands of organizations reportedly building workflows on top.

- Gemini 3 Pro’s longer context window and improved reasoning are particularly important for code, complex documents, and multi-step workflows where enterprise buyers benchmark hard against OpenAI and others.

Future and emerging tech that can reshape the sector

- Custom silicon (TPUs) becoming a peer to GPUs.

- Third-party analyses and interviews increasingly suggest TPUs deliver significantly better performance-per-watt and cost-per-token for large inference workloads than general-purpose GPUs, especially in Search-like queries and proprietary Google services.

- Alphabet is starting to open TPUs to external customers and to partners like Anthropic, seeding a potential “merchant AI silicon” business that could both diversify revenue and pressure Nvidia’s pricing power.

- Optical networking & CPO.

- Google’s adoption of advanced optical circuit switches and progress toward co-packaged optics promise large energy and latency savings at data-center scale, a key lever as AI power consumption becomes a national-grid-level issue.

- Spatial computing & XR.

- Partnerships bringing Android XR devices powered by Gemini hint at a future where AI agents live in mixed reality, not just in a chat box – with Google in a position to be the default assistant.

- Agentic workflows and live search.

- “Search Live” and other real-time Gemini experiences blend live web data, personal context, and voice into always-on assistants. If executed well, this could evolve Search from “ten blue links” into a persistent, multi-modal agent – both an opportunity and a UX risk.

Net: Gemini 3 Pro plus TPUs and optical networking give Alphabet a credible shot at structurally lower AI unit costs and a differentiated product. The sector reshapes around whoever can offer the most intelligence per watt and per dollar, at massive scale.

3. Q3 2025 – What the Numbers Actually Said

Key Q3 2025 points, ex-regulatory fine:

- Revenue: Just over $102B, +~16% YoY – Alphabet’s first ever triple-digit billion quarter.

- Segment growth:

- Search & Other: ~$56–57B, +14–15% YoY.

- YouTube Ads: ~$10.3B, +~15% YoY.

- Google Cloud: ~$15.2B, +~34% YoY.

- Profitability:

- Operating margin: ~33–34% after backing out a one-time European Commission fine.

- Google Cloud operating margin: ~23–24%, with segment operating income up ~85% YoY.

- Backlog & subs:

- Cloud RPO: ~$157–158B, with a bit over half expected to be recognized within 24 months.

- Paid subscriptions: >300M across YouTube and other services.

- Capex / cash:

- 2025 capex raised to $91–93B with commentary hinting 2026 spend will be even higher as AI infrastructure is built out.

- Despite the spend, Alphabet still generates tens of billions in annual free cash flow, giving it more room than almost any peer to fund AI build-outs.

Takeaway: fundamentals are strong, but the slope of capex is steep enough that every quarter now doubles as an AI ROI check-in.

4. Peer Check – Alphabet vs Other Hyperscalers

Microsoft (MSFT)

- Azure revenue grew ~40% YoY in the latest reported quarter, with AI services (especially OpenAI-powered workloads) a key driver.

- Capex hit record levels (~$35B in the quarter; full-year spend expected to rise further) as Microsoft races to add capacity, with management signaling supply will remain tight into 2026.

- Strategy is model-agnostic – hosting OpenAI plus other models – compared with Alphabet’s more “all-in-on-Gemini” bet.

vs GOOGL: Microsoft is ahead in enterprise AI monetization and developer mindshare via Azure/OpenAI; Alphabet responds with its own stack and cheaper silicon. Both face similar capex and adoption questions.

Amazon (AMZN)

- AWS is pushing its Nova model family, Bedrock platform, and custom Trainium chips; AI-heavy capex is ramping and AWS has deep enterprise relationships.

- Backlog is large and re-accelerating, but AWS has ceded some AI narrative ground to Azure and now Google.

vs GOOGL: Amazon has the strongest enterprise sales machine; Alphabet is narrower in enterprise reach but stronger in consumer surfaces and AI-enhanced advertising.

Meta (META)

- Meta’s AI spend is exploding (tens of billions in annual capex) to support Reels, ranking, and Llama-based products; Meta AI has >1B users across properties.

- But it lacks a public cloud business; monetization is mostly via better ad targeting and time-spent.

vs GOOGL: Meta is an AI-enhanced social network with no cloud; Alphabet is an AI-enhanced search/ads + cloud hybrid.

Oracle (ORCL)

- Oracle has repositioned as an AI infrastructure and database cloud provider, but the balance sheet is now highly levered after massive bond issuance to fund data-center expansion, raising questions about long-term risk if AI demand under-delivers.

vs GOOGL: Oracle offers high-growth AI infrastructure off a levered base; Alphabet offers similar AI upside with far stronger balance sheet and more diversified revenue.

Bottom line: Alphabet is in the leading cluster with Microsoft and Amazon: large cloud + AI, integrated chips and models, global reach. The key differentiators are Alphabet’s consumer surfaces, TPUs, and Gemini distribution versus Microsoft’s enterprise seat lock-in and OpenAI partnership and AWS’s enterprise depth.

5. Scenario Framework & Stock Targets (12–18 Months)

These are scenario ranges, not point forecasts. They assume:

- Current price ~$314 and trailing EPS ~$10.5.

- Time horizon: ~12–18 months.

- EPS figures below are rough forward estimates; P/E bands reflect different market moods around AI.

Bullish scenario – “AI Mode as Second YouTube”

Target range: $370–400

Assumptions:

- Revenue growth high-teens driven by:

- Search and YouTube sustaining mid-teens growth as AI Mode and Overviews lift engagement and monetization rather than cannibalizing it.

- Cloud growing 30%+ as backlog converts and Gemini-based workloads ramp.

- Company-wide operating margin holds in the 34–35% zone despite depreciation from new capex, as AI unit economics improve.

- Forward EPS steps up toward ~$11.5–12.0.

- Market assigns a premium 32–35x forward P/E for a clear AI winner with strong balance sheet.

Math check (midpoints):

- EPS 11.5 × 32 = 368

- EPS 11.5 × 35 = 402.5

→ Rounded $370–400 band.

Key catalysts to get here:

- Clear evidence that AI Mode/Overviews increase ad revenue per query.

- Continued Cloud share gains + margin expansion.

- Visible traction for TPUs as external AI compute (wins with big model providers, early “merchant silicon” signs).

- Regulatory outcomes that are noisy but ultimately manageable.

Base / neutral scenario – “Strong but Fully Priced Compounder”

Target range: $295–325

Assumptions:

- Revenue growth ~12–13%:

- Ads grow low-teens; Cloud high-20s; subs mid-teens.

- Operating margin settles around 31–32% as capex and D&A offset AI monetization gains.

- Forward EPS roughly $10.5–11.0.

- Market values Alphabet at a solid but not euphoric 28–31x forward P/E.

Math check (midpoints):

- 10.5 × 28 = 294

- 10.5 × 31 = 325.5

→ $295–325 band, with today’s price sitting near the upper half.

Path here:

- AI continues to work, but not dramatically better than expectations.

- Cloud and ads remain resilient; no big regulatory shock; capex is high but perceived as manageable.

- Stock behaves more like a quality core mega-cap than an AI moonshot.

Bearish scenario – “Capex Hangover & AI Friction”

Target range: $205–235

Assumptions:

- Macro or competitive pressure pushes Search & YouTube ad growth down to mid-single digits; AI products confuse users or deliver lower-than-hoped ROI to advertisers.

- Cloud growth slows toward ~20%, and margins fall back to high-teens/low-20s if capacity isn’t fully utilized or price competition intensifies.

- Company-wide margin compresses toward 28–29% as depreciation on $100B+ annual capex bites.

- Forward EPS stagnates around ~$9.0.

- Market derates Alphabet to a still-respectable but much lower 23–26x forward P/E amid broader AI-spend doubts.

Math check:

- 9 × 23 = 207

- 9 × 26 = 234

→ $205–235 band.

What could drive this:

- Clear evidence that AI Mode reduces profitable search behavior (lower click-throughs, weaker advertiser returns).

- Slower-than-expected enterprise adoption of Gemini/Vertex AI, or customers leaning harder into multi-cloud/cheaper neo-cloud providers.

- A major regulatory remedy affecting Search ranking, Android bundling, or data usage.

- Market decides hyperscaler AI capex is a mini-bubble and compresses multiples across the group.

Takeaway

Alphabet today is not a speculative AI token – it’s a cash-rich, highly profitable platform with:

- Dominant positions in Search and YouTube,

- A fast-improving, profitable Cloud business, and

- A credible full-stack AI strategy anchored by Gemini and TPUs.

The trade-off is that management is committing to enormous, multi-year AI capex that will only look wise if Gemini-driven revenue and Cloud AI demand keep scaling into 2026–27.

For long-term investors comfortable with that trade-off, GOOGL still looks like one of the cleaner ways to own the AI infrastructure and application stack in a single ticker. For shorter-term traders, the stock at ~24x trailing earnings and near base-case fair value leans more toward “buy the dips / trim the euphoria” than “back up the truck at any price.”

Disclaimer: This analysis is for educational purposes only and is not investment advice. It does not consider your personal financial situation or objectives. Do your own research and consult a licensed financial advisor before making investment decisions.