In a Nutshell

- Oracle’s credit risk has sharply repriced. Oracle’s 5-year CDS has blown out to the highest level since 2009 and roughly tripled from mid-year levels as investors hedge a debt-funded AI build-out with uncertain payback.

- Its balance sheet now resembles a leveraged AI infrastructure project: roughly $105B in total debt (including leases) and about $95B in U.S. bonds, making it the largest non-bank issuer in major corporate bond indices. Leverage sits above 4× debt/EBITDA, and trailing levered free cash flow is negative as capex ramps.

- Rating agencies remain investment grade but have shifted outlooks to Negative, explicitly citing massive AI cloud contracts and prolonged negative free cash flow.

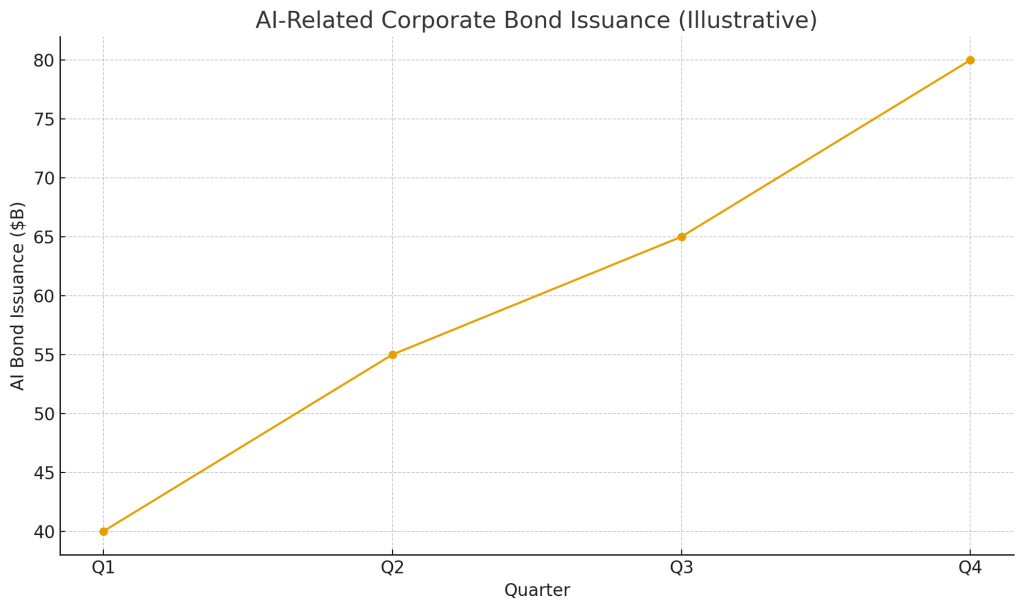

- Across the AI complex, more than $200B of AI-related bond issuance has hit the market, with hyperscalers and data-center operators raising capital aggressively alongside private-credit financings for infrastructure.

- Systemic risk is rising at the margin, not acutely. Regulators and large asset managers warn that AI-linked leverage may become a vulnerability for credit markets and long-duration rates, but Oracle itself is not considered a systemic institution.

Putting it all together, Oracle is a high-beta node in the AI credit web — a stress indicator, not a systemic trigger.

Oracle’s Bond Market Stress: What the Tape Is Saying

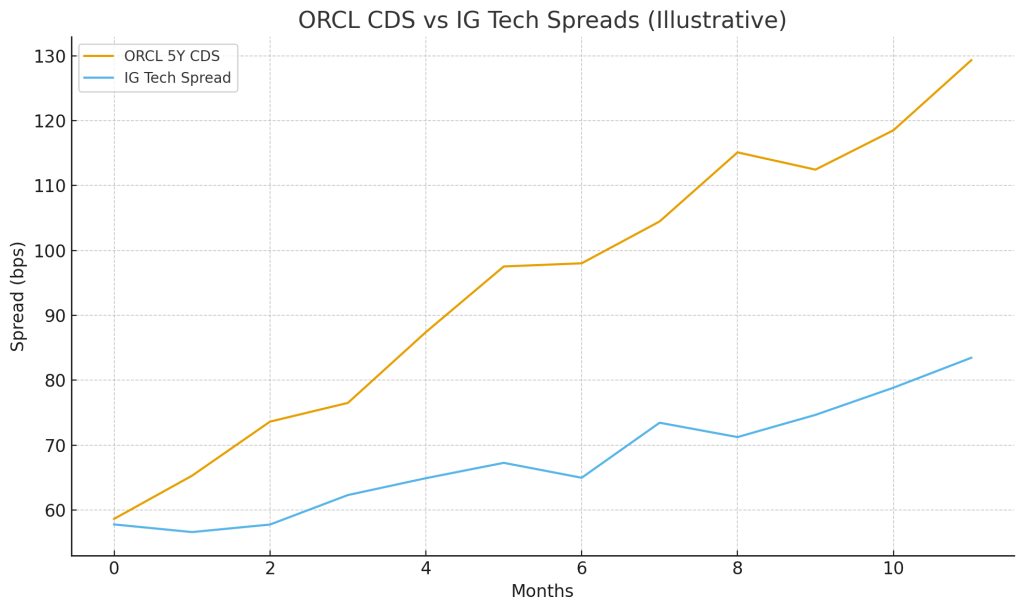

CDS and Spreads

- Oracle’s 5-year CDS protection has surged to levels last seen during the financial crisis, roughly tripling versus mid-year as investors increasingly use ORCL as a proxy hedge for an AI correction.

- Trading volumes have exploded from low hundreds of millions to multi-billion-dollar turnover in recent weeks as macro and credit desks pile in. Oracle has become an index-like hedge vehicle.

- Cash bonds have underperformed the broader investor-grade (IG) tech universe as spreads and yields reprice higher, even though overall IG spreads remain historically tight.

Platting Oracle 5Y CDS vs. the U.S. IG Tech index, we now see a clean divergence: Oracle decoupling sharply while the broader tech IG basket drifts modestly wider.

Size, Leverage, Funding Mix

Key realities:

- Total debt (incl. leases): ~$105B

- U.S. dollar bonds included in major IG benchmarks: ~$95B

- Recent jumbo deal: $18B multi-tranche offering with maturities out to 40 years to fund AI infrastructure

- Leverage: expected to remain >4× debt/EBITDA for several years

- Free cash flow: negative (approx. −$2.8B trailing) due to aggressive capex

Economically, Oracle is transitioning from a software cash cow to a leveraged infrastructure build-out, with heavy upfront investment and long-dated monetization cycles.

Rating Stance and Refinancing Risk

- Moody’s: Baa2, Negative outlook

- S&P: BBB, Negative outlook

- Fitch: BBB, Stable

Oracle has one notch of cushion before “fallen angel” territory. A downgrade to the cusp of high yield would force index-mandated selling and increase refinancing costs — not catastrophic, but meaningfully negative for spreads.

Maturities are laddered evenly, so no single refinancing wall exists. The real issue is higher all-in yields if spreads continue widening while rates stay elevated.

Is This Systemic Risk or Sector-Specific Stress?

To be systemic, a shock must meaningfully threaten the functioning of core financial plumbing (banks, liquidity, collateral chains). Oracle does not meet that bar today.

What Oracle is, however, is:

- a major constituent of investor-grade (IG) indices,

- a liquid hedge instrument for AI credit risk,

- and one of the clearest real-time barometers of AI-capex financial sustainability.

If Oracle materially disappointed on AI workload monetization or free cash flow, the impact would ripple across:

- IG tech spreads,

- AI-heavy issuers,

- credit ETFs,

- and broader investor sentiment.

Still: this is sector stress, not systemic stress.

The True Systemic Channel: The AI Debt Wave

The emerging systemic risk is not “Oracle collapses,” but the scale and concentration of AI-related leverage across public bonds, private credit, and infrastructure financing:

- AI-linked corporate issuance exceeds $200B this year.

- Private credit funds are heavily exposed to data-center and power infrastructure.

- Large market participants warn that AI capex is now driving long-duration supply, raising vulnerabilities in both corporate credit and Treasuries.

If AI returns disappoint, the feedback loop runs through public credit, private-credit vehicles, and interest-rate markets — that is the systemic channel worth watching.

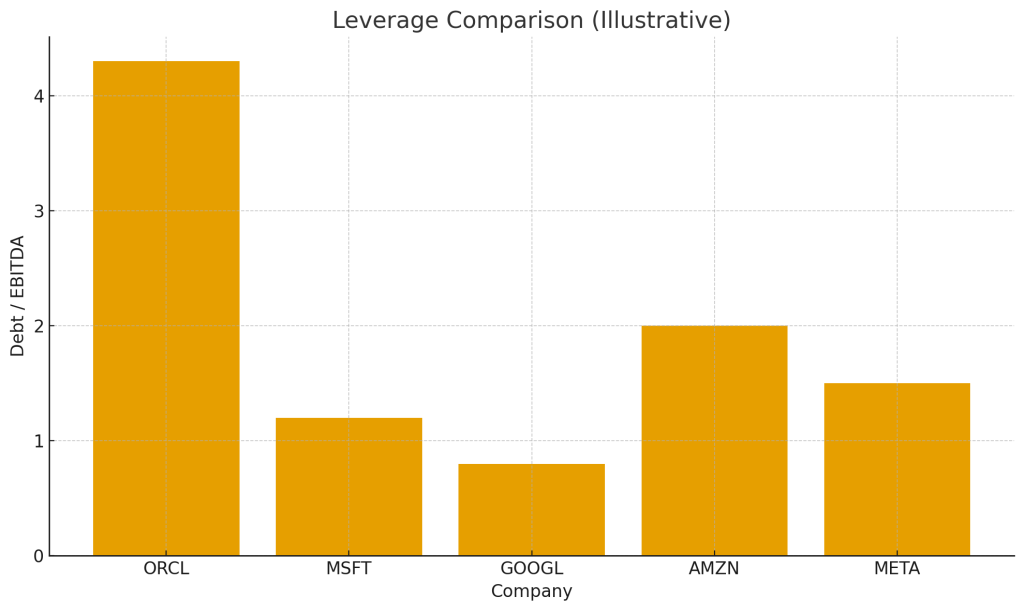

How Oracle Compares to Peers in the AI Complex

Hyperscalers: Microsoft, Alphabet, Amazon, Meta

- Microsoft (MSFT): AAA-rated, massive net cash position, enormous free cash flow. AI and cloud capex is entirely self-funded.

- Alphabet (GOOGL): Conservative leverage, large liquidity pool, near-record AI/data-center spending supported by strong cash generation.

- Amazon (AMZN): Higher gross leverage but strong AWS cash flow; recent bond deals are opportunistic, not balance-sheet dependent.

- Meta (META): Significant AI and infrastructure spend funded through both public and private structures, but balance-sheet strength remains high.

Across these companies, the pattern is clear: self-funding AI from free cash flow, with bond issuance a complement, not a necessity.

Oracle stands out because:

- leverage is higher (>4×),

- ratings are weaker,

- free cash flow is negative,

- and AI growth must accelerate meaningfully to justify the balance-sheet load.

AI Hardware and Semiconductors

The major semiconductor providers (NVIDIA, Broadcom, AMD) are equity-driven stories, not credit-risk stories:

- very strong cash generation,

- light bond issuance,

- limited leverage,

- minimal refinancing exposure.

Thus, AI credit risk sits primarily with cloud platforms, data-center operators, and infrastructure debt — not chipmakers.

Scenario Map: When Does This Become Dangerous?

“AI Delivers On Time” (Bullish/Base)

- AI workloads ramp successfully; Oracle monetizes contracted workloads.

- Leverage trends down toward the 3× range.

- Free cash flow turns sustainably positive.

- Ratings stabilize, CDS tightens, and Oracle credibly re-enters “normal IG tech” territory.

In this case, the broader risk lies in duration exposure — not Oracle credit.

“Slow Payoff / Overbuild” (What Markets Are Pricing Now)

- AI demand grows but not quickly enough to justify capex intensity.

- Utilization disappoints; economics lag.

- Leverage stays stuck >4×; free cash flow volatile.

- Oracle becomes a perennial “fallen-angel risk” name.

AI-heavy IG credit would underperform; HY and private credit tied to AI infrastructure would see losses.

“Hard Landing + AI Bust” (Tail Event)

- Macro downturn hits into peak AI capex.

- Revenues fall short simultaneously across AI projects.

- Multiple issuers face downgrades or distress.

- Private credit and infrastructure vehicles take valuation hits.

- Long-duration Treasuries sell off due to supply pressure.

This is the pathway to true systemic stress — not from Oracle alone, but from the aggregate leverage embedded in AI infrastructure financing.

Playbook: How to Trade and Hedge the AI Credit Complex

Signals to Watch (“Oracle Credit Dashboard”)

- Oracle 5Y CDS vs. IG Tech spreads

- Rating-agency commentary on leverage and free cash flow

- Quarterly free cash flow vs. capex trajectory

- AI-linked IG issuance levels and ETF flows

These four areas will tell you whether Oracle stress is idiosyncratic or becoming a broader regime shift.

Credit Positioning

Relative-value bias:

- Favor higher-quality IG tech exposure (Microsoft, Alphabet) over leveraged AI builders.

- Underweight or hedge Oracle credit until free cash flow inflection is visible.

Curve/duration stance:

- Prefer intermediate maturities over 30–40-year paper given heavy AI-linked long-duration issuance.

- Avoid structurally illiquid, low-coupon, long-dated Oracle tranches.

Event-driven opportunity:

- A downgrade to BBB-/Baa3 could trigger forced selling.

- Crossover investors may find attractive entry points in specific Oracle maturities with overshoot pricing.

Equity Playbook

Pair trades:

- Long Microsoft or Alphabet equity vs. short Oracle equity when Oracle CDS widens or rating pressure increases.

Volatility strategies:

- Use options around catalysts such as Oracle earnings, AI contract disclosures, or rating updates.

- Oracle’s equity is tightly correlated with credit conditions given leverage.

Macro and Tail-Risk Hedging

- Reduce exposure to long-duration sovereigns if AI-driven supply pressures continue.

- Use credit-index hedges (CDX IG/HY, LQD/HYG) when AI issuance spikes.

- Monitor private-credit and infra-fund exposures to AI data-center assets.

Takeaways for the AI Cycle

- Oracle is the canary, not the mine. Its credit stress highlights investor fatigue with debt-funded AI expansion without clear free cash flow visibility.

- The AI credit cycle is large and growing — this is now a multi-year macro driver, not a quarterly narrative.

- Markets are entering the discrimination phase: self-funded AI models are rewarded; leveraged models are punished.

- Systemic risk is still a tail, but a fatter tail than a year ago. Oracle’s credit profile is one of the best barometers of how that tail risk is evolving.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Conduct your own due diligence and consult with a licensed financial advisor before making investment decisions.