Highlights

Salesforce delivered a quarter that was operationally excellent but not growth-explosive:

- Revenue around $10.3B, growing high single digits year-on-year.

- Non-GAAP operating margin in the mid-30s, at or near record levels.

- Free cash flow above $2B for the quarter, with healthy double-digit growth.

- AI stack (Agentforce, Data Cloud, Einstein) now represents meaningful, recurring ARR, scaling quickly off a small base.

- Guidance frames high-single-digit to low-double-digit top-line growth with mid-30s non-GAAP margin for the full year.

The equity story is shifting from “hyper-growth CRM pioneer” to “AI-enhanced, cash-rich enterprise platform compounder.”

At today’s valuation, the market is debating whether Salesforce is:

- A mature, high-quality software utility with an AI kicker, or

- A slowing legacy SaaS name that uses buybacks and efficiency to mask a decelerating core.

Our view: CRM works as a quality compounder and AI enabler, not as an AI moonshot. Upside is driven by sustained mid-30s margins, steady high-single-digit revenue growth, and incremental AI re-acceleration.

What Q3 Delivered

Top line

- Total revenue: roughly $10.3B, +~9% Y/Y.

- Subscription & support (the bulk of the business) grew around 10% Y/Y.

- Professional services and other remain a small drag on growth and margin, as usual.

Profitability

- Non-GAAP operating margin landed around 35–36%, up nicely year-on-year.

- GAAP margin is materially lower due to stock-based comp but remains firmly positive.

- Salesforce is now operating solidly in “Rule of 40” territory: growth + non-GAAP margin in the mid-40s.

Cash & capital allocation

- Operating cash flow exceeded $2.3B; free cash flow about $2.2B, implying a low-20s FCF margin.

- Balance sheet is effectively net cash when you net out debt versus cash and investments.

- Management is running an active buyback program, steadily shrinking share count and offsetting SBC.

Forward visibility

- Current remaining performance obligations (cRPO) sit near $30B, low-double-digit growth.

- Full-year revenue guidance implies high-single-digit to low-double-digit growth.

- Non-GAAP operating margin guide in the mid-30s signals management’s commitment to efficiency.

Business Model, AI Stack & Moat

Salesforce is effectively an operating system for customer data and engagement across sales, service, marketing, commerce, analytics and apps.

Key layers of the moat:

- Data gravity & integration

- Salesforce owns highly structured, business-critical objects (accounts, opportunities, cases, campaigns).

- Deep integrations into ERP, email, telephony, and thousands of ISVs make it painful to rip out.

- Platform & ecosystem (Hyperforce, AppExchange, MuleSoft, Slack)

- Hyperforce gives cloud-agnostic deployment and data residency, easing regulatory concerns.

- AppExchange and partner ecosystem create a long tail of vertical solutions that reinforce stickiness.

- MuleSoft and Slack act as connective tissue and engagement layer for workflows beyond CRM.

- AI portfolio (Agentforce, Einstein, Data Cloud)

- Agentforce: AI agents for sales and service that can act on CRM data and workflows, not just generate text.

- Einstein: embedded predictive/GenAI features across clouds (scoring, recommendations, auto-drafts).

- Data Cloud: unifies customer data from multiple sources into a real-time, queryable graph; key for AI.

AI is not just a point feature; it’s gradually becoming the default UX for working with Salesforce data. The moat here is less about raw model quality and more about first-party enterprise data, workflow integration, and trust/compliance.

Strengths

- High-quality financial profile

- Mid-30s non-GAAP operating margins and low-20s FCF margins.

- Recurring revenue base with good visibility via cRPO and multi-year contracts.

- Strong balance sheet enabling continued buybacks and selective M&A.

- Mission-critical product with low churn

- Salesforce is deeply embedded in sales and service organizations.

- Rip-and-replace is disruptive, risky, and politically painful; migrations tend to be slow and partial.

- Breadth of cloud portfolio

- Sales, Service, Marketing, Commerce, Platform, Tableau, Slack, Data Cloud, plus industry clouds.

- Cross-sell and upsell remain important drivers: AI features tend to attach to existing workloads.

- AI and data positioning

- Salesforce sits on top of decades of clean, labeled customer and workflow data.

- AI offerings are aligned with clear business outcomes (faster case resolution, higher win rates, better pipeline hygiene) rather than generic “chatbots”.

- Improved discipline and governance

- Activist pressure over the last 2–3 years forced Salesforce to focus on profitability, FCF, and ROIC.

- More disciplined M&A stance and tighter cost controls have structurally improved margins.

Weaknesses & Risk Factors

- Growth ceiling in core CRM

- Sales and Service clouds are relatively mature in large enterprises.

- SMB/Commercial segments face more competition from cheaper, simpler solutions (HubSpot, Zendesk, etc.).

- Without meaningful acceleration in Data Cloud and AI, the business risks settling into permanent high-single-digit growth.

- Complexity and deployment friction

- Implementations can be slow, expensive, and heavily dependent on systems integrators.

- Complexity can drive frustration and over-licensing, which becomes a lever in renewal negotiations.

- Competitive intensity

- Microsoft bundles CRM-adjacent capabilities into Microsoft 365 and Dynamics with aggressive pricing.

- ServiceNow encroaches on workflows and service cases; Adobe dominates in marketing and content.

- Vertical SaaS (e.g., healthcare, financial services, real estate) builds tailored front ends on top of or instead of Salesforce.

- Execution risk in AI narrative

- AI ARR is growing fast but from a small base; investors can get impatient if AI revenue doesn’t move the total growth needle.

- There is risk that AI attach rates plateau or that customers push back on pricing for AI seat uplift.

- SBC and culture

- Stock-based compensation remains meaningful; while partially offset by buybacks, it still dilutes if growth slows.

- The company has gone through multiple reorganizations and acquisitions; maintaining a coherent, innovative culture at scale is non-trivial.

Peer Context & Valuation Frame

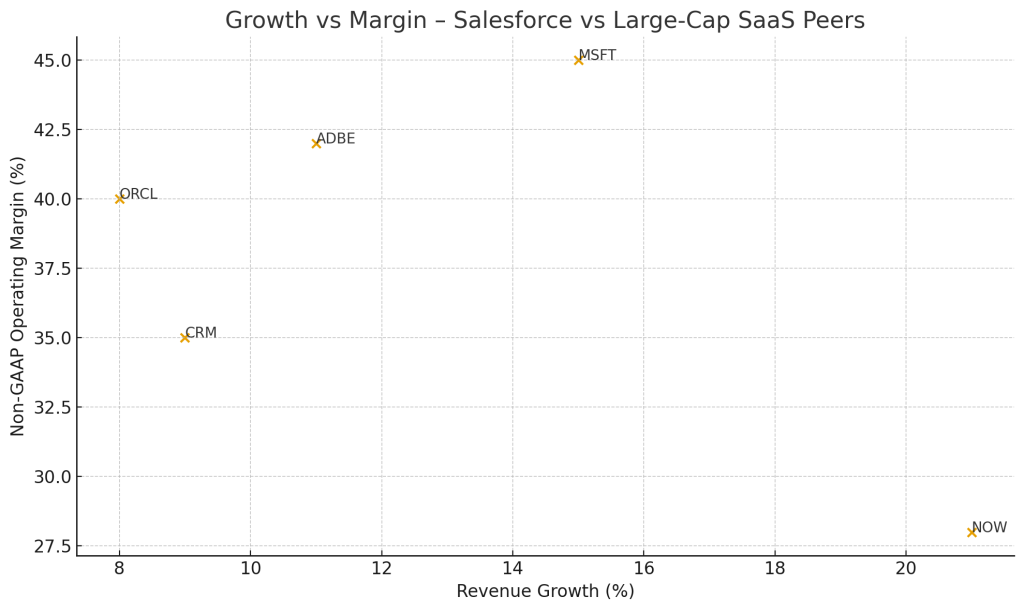

Think of Salesforce versus a peer set of large-cap, enterprise-focused software names: Microsoft (MSFT), Oracle (ORCL), Adobe (ADBE), and ServiceNow (NOW).

- Growth:

- CRM: high-single-digit to around 10% revenue growth.

- NOW: still in the low-20s.

- MSFT and ADBE: roughly mid-teens.

- ORCL: high-single-digit growth, like CRM.

- Margins:

- CRM: mid-30s non-GAAP op margins.

- MSFT and ADBE: materially higher (low-to-mid-40s).

- ORCL: around 40%.

- NOW: lower margin, higher growth.

- Positioning:

- Salesforce sits between mature cash cows like ORCL and faster-growing platforms like NOW, with stronger growth than ORCL but lower growth than NOW, and strong margins that are competitive across the group.

On a typical forward multiple stack:

- CRM tends to trade at a discount to MSFT/NOW/ADBE on EV/Sales and EV/FCF, and closer to ORCL, reflecting its intermediate growth profile.

- Given mid-30s margins, solid FCF and ongoing buybacks, a modest valuation re-rating is plausible if AI adds even 1–2 points of durable growth over the next 2–3 years.

CRM’s Growth Through Charts

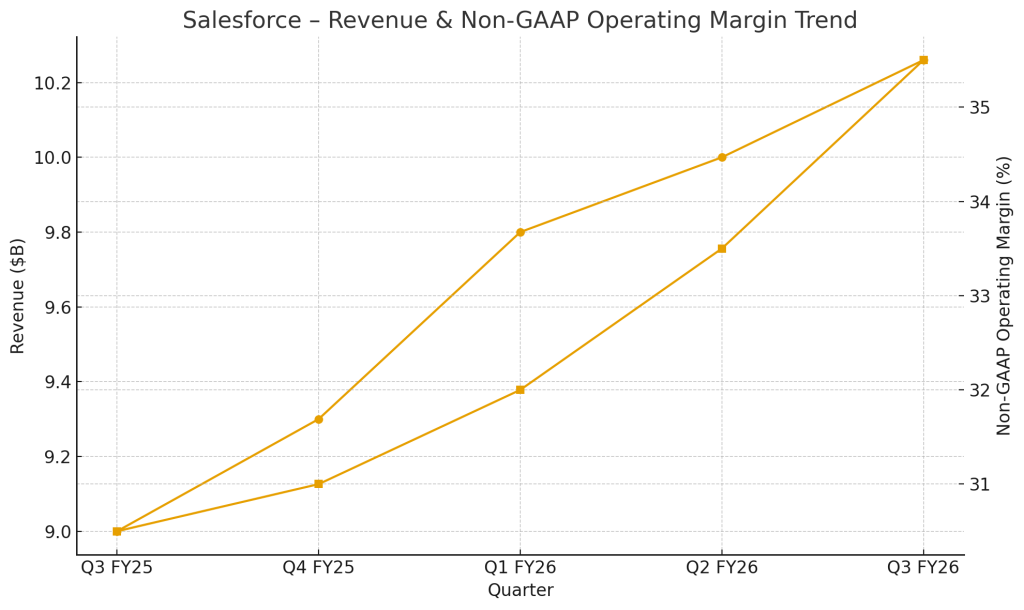

Revenue & Margin Trend

Salesforce’s last few quarters of steady revenue growth with a clear margin ramp into the mid-30s.

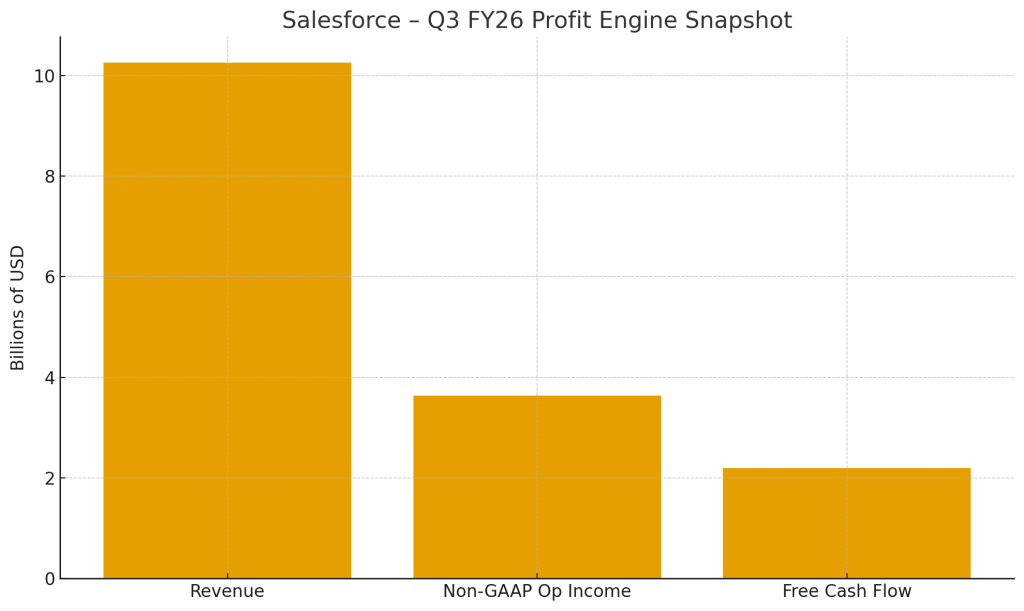

Q3 FY26 Profit Engine Snapshot

Revenue, non-GAAP operating income, and free cash flow for the quarter, highlighting the conversion from revenue to profit and cash.

Growth vs Margin – Salesforce vs Large-Cap SaaS Peers

Scatter plot situating CRM vs MSFT, ORCL, ADBE, NOW on a growth vs margin plane, visually reinforcing that Salesforce is a high-margin, mid-growth compounder rather than a hyper-growth name.

Investing Playbook

CRM fits investors who want:

- A quality compounder with mid-30s margins and consistent FCF, not hyper-growth.

- AI-adjacent exposure anchored in enterprise workflows and data rather than semis.

- GARP: mid-single- to low-double-digit revenue growth, disciplined capital returns, and a valuation that still leaves room for multiple expansion if AI execution is solid.

Scenario Framework (12–18 Month View)

Price targets here are scenario-based, not point forecasts. They use:

- A central EPS path stepping up toward ~$12–13 adjusted EPS over the next 12–18 months, and

- Different forward P/E bands reflecting how the market could price a high-margin, mid-growth enterprise platform under each outcome.

| Scenario | Narrative | Growth & Margin Profile | Implied Multiple & EPS | 12–18M Price Target* | Upside / Downside vs. ~$249 |

|---|---|---|---|---|---|

| Bull | AI agents and Data Cloud become mainstream across the base; AI + Data adds 2–3 pts to revenue growth by late 2026. Salesforce is re-framed as the default AI workflow layer for go-to-market and service. | Revenue growth trends toward 11–13%; non-GAAP margin drifts into the 36–38% range as scale benefits continue. | Market pays a ~26x forward P/E on ~$12.8 EPS (reflecting faster AI-driven growth and stronger sentiment). | ~$335 | ~35% upside |

| Base | AI attach is solid but not explosive; Data Cloud ramps steadily. Salesforce is valued as a high-margin, high-single-digit to low-double-digit grower, with AI viewed as an additive, not transformative, driver. | Revenue growth 8–10%, margin 34–36%. Rule-of-40 stays in the mid-40s; buybacks continue to shrink share count gradually. | Market assigns a ~23x forward P/E on ~$12.2 EPS, a modest premium to current forward multiples to reflect AI progress and capital discipline. | ~$280 | ~13% upside |

| Bear | AI monetization underwhelms, competition intensifies (especially from Microsoft bundles and vertical SaaS), and macro keeps IT budgets tight. Growth slips toward the low end of guidance and investors treat Salesforce more like a steady but ex-growth enterprise utility. | Revenue growth 5–7%, margin dips toward low-30s if Salesforce leans back into investment or M&A to re-ignite growth. | Multiple compresses toward a ~19x forward P/E on roughly current EPS power (~$11.8) as growth stalls. | ~$225 | ~10% downside |

Remember this: Targets are rounded midpoint estimates for the scenario; they’re not precise 12-month fair values, but anchors for risk/reward thinking.

Concrete Trade Ideas (Updated around Targets)

- Core Long – Quality Compounder Around the Base Case

- Thesis: The base case plays out: Salesforce grows high single digits to low double digits, margins hold mid-30s, AI adds incremental uplift but doesn’t fully re-rate the story. Over 12–18 months, the stock gravitates toward ~$280, with total return mostly driven by EPS growth + buybacks, and modest multiple expansion from current levels.

- Positioning:

- Build a core long and add on pullbacks that push the implied forward P/E closer to the high-teens.

- Review thesis if growth drifts below ~7% without a clear AI-driven recovery path.

- AI Barbell – Workflow vs. Infrastructure

- Thesis: CRM in the bull case can trade into the low- to mid-$300s (~$335 scenario) if AI ARR keeps compounding triple-digit and clearly lifts overall revenue growth. Pair it with a higher-beta AI infra name to capture upside on both compute and workflow, but lean on CRM’s mid-30s margins and FCF as ballast.

- Implementation:

- Long CRM as the defensive AI workflow leg with a bull target near $335.

- Pair with a more cyclical AI infra or GPU beneficiary; optionally overlay index or single-name puts to cushion macro drawdowns.

- Relative Value / Pair Trade vs. Slower Legacy Software

- Thesis: In the base to bull corridor ($280–$335), Salesforce screens as undervalued vs. slower-growing peers with similar or lower margins and less AI upside.

- Construction:

- Long CRM vs. a basket of slower enterprise software names whose growth and AI optionality are clearly inferior.

- The pair works if the market gradually closes the valuation gap between CRM’s current high-teens/low-20s forward P/E and the mid-20s level typical of premium large-cap software.

- Risk-Managed Options Overlay

- Bull-leaning call diagonal:

- Own a long-dated call with strikes around the $260–280 area (just above current spot and near the base case target).

- Finance part of the premium by selling shorter-dated OTM calls closer to $320–330, near the lower end of the bull target zone.

- Downside hedge:

- Use put spreads with floors around $220–225 (bear scenario) to define risk while keeping core shares or LEAPs intact.

- Bull-leaning call diagonal:

Key Watchpoints for the Next 12–18 Months

- AI attach and ARR disclosure

- Look for continued triple-digit growth in AI-related ARR, but also for signs that it is starting to move the total revenue growth needle by 1–2 points.

- Data Cloud adoption

- Data Cloud is the foundation for meaningful AI on Salesforce; watch for customer logos, standardized pricing, and usage metrics.

- Net revenue retention (NRR) and large-account behavior

- NRR stability or improvement would validate that Salesforce is successfully upselling AI and platform features rather than facing discount pressure at renewal.

- M&A discipline

- Any large, dilutive acquisitions would be a red flag that management is reverting to old habits.

- Capital returns

- Continued share count reduction and strong FCF growth are central to the thesis in a mid-growth world.

Takeaway

Salesforce is transitioning from a story about top-line expansion to a story about high-margin, AI-enabled compounding on an entrenched data and workflow moat.

For investors comfortable owning a mature but still innovating platform with solid FCF, strong competitive positioning, and credible AI upside, CRM deserves serious consideration as a core holding rather than a trading vehicle.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Conduct your own due diligence and consult with a licensed financial advisor before making investment decisions.