The Position

Here’s an interesting setup on UPS with earnings coming October 23rd (just under 4 weeks away):

- Long 5 shares at $84.31

- Long October 24 $86 call

- Long October 24 $87 put

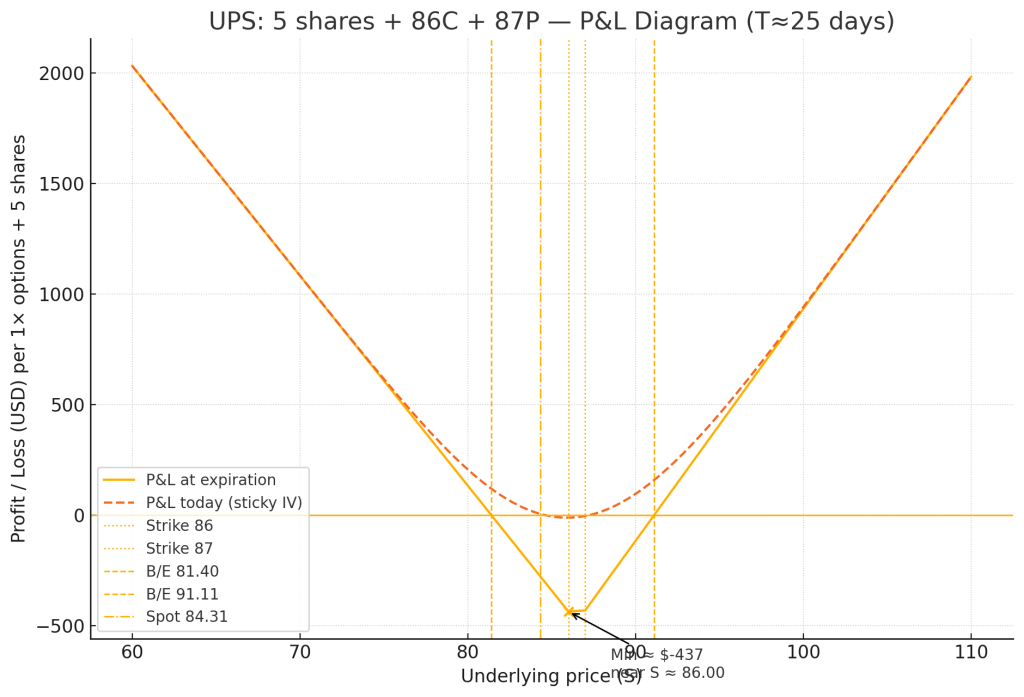

Notice something unusual? The put strike is above the call strike. This inverted structure, sometimes called a “split strike” position, is fascinating given we have nearly a month to play this. Let me break down why this makes sense.

Quick fact sheet

- Stock: $84.31 | Market Cap: ~$71B | PE/Fwd PE: 12.45 / 11.71 | PEG: 10.12

- P/S: 0.79 | P/B: 4.51 | ROE: 34.96%

- 52‑wk position: –41.85% from high, +2.83% from low | ATR ~2.04% | β ~1.08

- Options tape: IV rank ~67%, IV–RV ~11.57 vol pts, OI ~682k, spread ~$0.16.

- Key dates: Earnings 2025‑10‑23 → Expiry 2025‑10‑24.

The UPS Story Nobody’s Talking About

UPS is trading like it’s 2008, but the fundamentals tell a completely different story. The stock’s down 42% from its 52-week high, sitting near 52-week lows (only 2.83% above), yet it’s sporting a PE of 12.45 and forward PE of 11.71. That’s absurdly cheap for a company with a 34.96% return on equity.

Here’s what I think is happening: The market’s pricing UPS like e-commerce is dead and Amazon’s going to deliver everything themselves. Meanwhile, the company’s still generating massive cash flows (note that 96% payout ratio – they’re literally returning almost everything to shareholders).

The Street’s been bearish all year, but operating leverage in logistics is brutal both ways. When volumes stabilize – and Q3 seasonality suggests they should – margins can snap back violently.

Why This Structure Works

The inverted collar ($87 put/$86 call) with a month to run is brilliant for this situation:

Time Decay Dynamics: With 25 days until expiration, we have time for the thesis to develop. The position benefits from any significant move over the next 3 weeks, not just the earnings event.

Volatility Is Asleep: IV at 26% for both options with earnings inside the expiration window? That’s criminally low. As we approach October 23rd, this could easily expand to 35-40%. That expansion alone could make this trade profitable.

The Coiled Spring: At $84.31, we’re below both strikes. The stock needs just a 2% move to put the call in play, or it can drop and the put provides immediate protection. Given the 42% drawdown, mean reversion in either direction is likely.

Multiple Paths to Profit

Path 1: Pre-Earnings Momentum The next three weeks give UPS time to build momentum. Any positive macro data on shipping volumes, holiday season outlook, or competitor results could spark a relief rally. A move to $88-90 before earnings puts both the stock and call nicely in profit.

Path 2: Volatility Expansion Trade Even if UPS stays flat at $84, IV expansion from 26% to 35-40% as earnings approach could add $0.50-1.00 to each option. By October 20th, you could exit the entire position for a 20-30% gain without taking earnings risk.

Path 3: The Earnings Catalyst Hold through October 23rd earnings. UPS has moved 5-8% on recent reports. With the stock this oversold, any stability in guidance could trigger a sharp rally to $90+. The inverted structure means you win big on a breakout above $91.11.

Path 4: The Flush and Bounce If UPS breaks below $80 in the next two weeks (completing the capitulation), the put becomes increasingly valuable while you could potentially roll the call strike lower or add to the equity position at extreme oversold levels.

Risk Management Reality Check

Let’s be clear about the risks:

- Maximum loss sits around $400-500 if UPS stays pinned at $86-87 (worst case scenario)

- The inverted structure means you’re short volatility between the strikes

- October 24 expiration (one day post-earnings) leaves no room for error on timing

However, the 2.71 short ratio and minimal insider selling (0.02%) suggest no major red flags. Institutions actually adding (-1.17% is barely negative) tells me smart money might be accumulating down here.

The Technical Setup

Looking at the IV rank at 11.57 (79th percentile), we’re at the low end of the volatility range despite being near 52-week lows. This disconnect usually doesn’t last. Either the stock recovers or volatility expands – both scenarios favor this position.

The stock’s been consolidating between $81-85 for weeks. This compression typically precedes a significant move. With earnings as the catalyst and the oversold condition, the risk/reward skews bullish.

Bottom Line

This UPS trade is a smart play on a quality company that’s been left for dead. The inverted collar structure provides multiple ways to win over the next month while defining risk clearly. You’re essentially betting that UPS moves more than 3% in either direction over the next 25 days, with an earnings catalyst to boot.

Given where UPS is trading relative to fundamentals (P/S of 0.79, PEG of 10 but that’s backward-looking), the 20% upside to analyst targets, and the extreme pessimism baked into the stock, this asymmetric setup makes sense.

The key is having a plan. Consider taking profits on any volatility expansion pre-earnings, or size it to hold through the event. Either way, you’re playing a beaten-down blue chip with multiple catalysts and defined risk.

Sometimes the best trades are in the stocks everyone’s forgotten about. UPS fits that bill perfectly right now.

This analysis is for educational purposes only and not personalized investment advice. Trading involves risk and may not be suitable for all investors.