Thematic Lens: Baseload Stability, AI Infrastructure Energy Demand, Next-Gen EGS Technologies

Executive Summary

The geothermal energy sector is undergoing rapid expansion, fueled by escalating global electricity demand, projected at +4% annually through 2027. Favorable policy environments, particularly the January 2025 U.S. Executive Orders declaring a national energy emergency aimed at boosting domestic geothermal production, are providing significant growth catalysts. Additional state-level incentives such as Nevada’s generous 55% property tax abatements and California’s stringent mandate for 1GW firm geothermal capacity further enhance the sector’s attractiveness.

Technological advancements, particularly Enhanced Geothermal Systems (EGS) and superhot rock geothermal, promise substantial growth, potentially delivering up to 4.3 terawatts of clean, firm power in the U.S. alone – far exceeding current domestic electricity consumption. Ormat Technologies (NYSE: ORA) remains the clear sector leader, capitalizing on its vertically integrated business model, strong financials ($880 million annual revenue in 2024), and broad geographic diversification. Strong regional competitors, including Green Tech International (BVB: GREEN) in Europe and Contact Energy (NZE: CEN) in New Zealand, also showcase significant operational and financial strengths.

Market Dynamics: Leaders and Emerging Competitors

| Company | Ticker | Key Strengths | Strategic Risks |

|---|---|---|---|

| Ormat Technologies | NYSE: ORA | Global leader, $4.4B market cap, 1.5 GW capacity, 84% capacity factor | High leverage (4.0x net debt-to-EBITDA), seismic/geological risks |

| Green Tech International | BVB: GREEN | Europe’s largest geothermal portfolio (83 wells, 300 MWth), strong IPO | Limited focus on thermal vs. electricity generation, regional focus |

| Contact Energy | NZE: CEN | 67% cash flow growth, Tauhara 174MW commissioning, strong domestic utility | Hydro/gas volatility, single-market exposure |

| KenGen | NRB: KGN | Dominates Kenya with 330+ wells and 65% national market share | Heavy reliance on government and regulatory stability |

| Pertamina Geothermal Energy | IDX: PGEO | Strong balance sheet, low funding cost (3.75%), 0.37x debt-to-equity | Delays in commissioning, policy exposure |

| Polaris Renewable Energy | TSX: PIF | 82MW Nicaragua geothermal, diversified with hydro and solar | Latin American exposure risk, smaller scale |

| Vulcan Energy Resources | ASX: VUL | Lithium-geothermal integration, strategic assets in Germany’s Upper Rhine | Pre-revenue stage, permitting and execution risk |

Strategic & Market Outlook

- Rapidly Growing Demand: Accelerated by electrification trends, notably from the expanding AI-driven data center sector.

- Policy and Regulatory Tailwinds: Streamlined permitting processes in the U.S., Nevada’s significant tax abatements, California’s firm geothermal requirement.

- Technological Innovations: Significant investment growth in next-gen geothermal projects, quadrupling from 2021-2023, reaching $420 million.

- Corporate Support: High-profile commitments exemplified by Google’s 10MW geothermal power purchase agreement in Taiwan, doubling the nation’s geothermal output.

- Sector Challenges: High initial investment, geological and seismic uncertainties, and evolving regulatory frameworks.

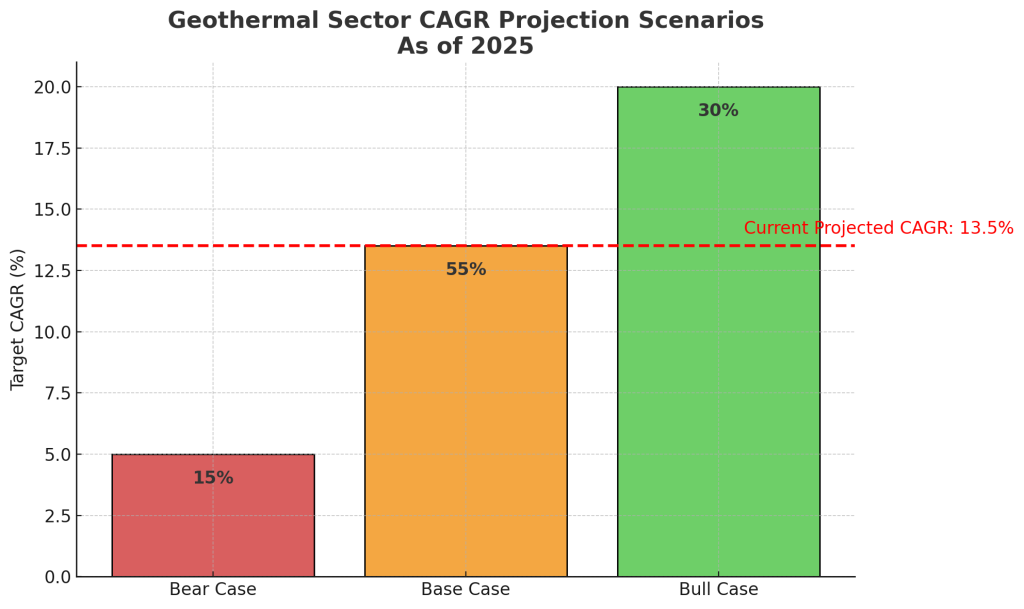

Investment Scenarios & Sector Growth Map (2025-2030)

| Scenario | Drivers & Assumptions | Sector CAGR |

| Bull | Accelerated EGS adoption, stable policy environment, strong corporate demand | 20%+ |

| Base | Moderate technological progress, steady policy support, incremental demand growth | 13.5% |

| Bear | Technological setbacks, reduced policy incentives, elevated capital costs | ~5% |

Investor Fit Matrix

| Investor Type | Investment Rationale |

| Climate Impact Investors | Geothermal provides reliable baseload power with zero emissions, complementing intermittent renewables |

| AI & Tech Infrastructure | Continuous, stable power critical for energy-intensive tech and data center operations |

| Value Investors | Opportunities in undervalued regional firms and potential valuation re-rating |

| Emerging Market Investors | Access to high-growth geothermal projects and attractive yield opportunities in developing markets |

| ESG-Focused Investors | Alignment with sustainable and impact-focused investment objectives, eligible for green bond financing |

Competitive Landscape Highlights

- Technology Innovators: Ormat Technologies (advanced binary cycle technology), Climeon AB (efficient low-temperature ORC technology), Vulcan Energy Resources (integrating lithium extraction with geothermal power generation).

- Geographic Expansion: Notable activity and strategic expansions in markets such as Croatia, Romania, Indonesia, Kenya, and Taiwan.

- Sector Consolidation Potential: Ormat well-positioned for strategic acquisitions and market consolidation with recent $500M debt financing.

Final Analysis

Geothermal energy is solidifying its position as a critical pillar of global clean energy strategy. Driven by technological breakthroughs, strong policy support, and escalating corporate adoption, the geothermal sector presents rapid growth potential and strategic investment opportunities.

Our Investment Call

ETF Strategy: Consider pairing broad clean-energy ETFs (such as Global X Renewable Energy Producers ETF – RNRG or iShares Global Clean Energy ETF – ICLN) with select pure-play geothermal stocks like Ormat Technologies (ORA) for optimized exposure and diversification.

Sector Leader: Ormat Technologies (NYSE: ORA) – recommended overweight due to its unmatched global presence and integrated operational strength.

Growth & Yield Opportunities: Contact Energy (NZE: CEN), Polaris Renewable Energy (TSX: PIF) – compelling investment cases offering growth and stable dividends.

European & ESG Exposure: Green Tech International (BVB: GREEN) – suitable for investors targeting regional diversification and sustainability impact.