Investment Thesis: Marvell Technology (NASDAQ: MRVL) is executing a strategic transformation from a diversified semiconductor vendor into a specialized AI infrastructure provider, presenting significant upside potential alongside execution and concentration risks.

Executive Summary

Current Price: ~$70 (down 45% from 52-week high of $127.48)

Market Cap: ~$60B

Investment Grade: Speculative Growth with High Conviction Required

Key Strengths: Exceptional AI demand tailwinds, $75B lifetime revenue pipeline from custom silicon, differentiated technology portfolio across critical AI infrastructure components

Primary Risks: Severe customer concentration, margin compression from manufacturing cost inflation, execution dependencies on limited foundry capacity

Strategic Transformation: From Diversification to AI Specialization

Marvell has completed one of the semiconductor industry’s most decisive strategic pivots, transitioning from a multi-market approach to focused AI infrastructure specialization. This transformation represents both operational excellence and strategic necessity in an increasingly competitive landscape.

Financial Performance Metrics:

- Revenue Growth: 63% YoY in Q1-FY26 to $1.9B

- Data Center Revenue Mix: 76% of total revenue vs. 44% in FY24

- Pipeline Value: $75B in lifetime revenue potential from current design wins

- R&D Investment: 29% of sales, demonstrating commitment to innovation leadership

The company’s transformation extends beyond revenue mix changes. Marvell has systematically repositioned itself as the foundational infrastructure provider for AI computing, focusing on the interconnect, optical, memory, and power delivery technologies that enable large-scale AI deployments.

The Technology Moat: Why Competitors Are Still Playing Catch-Up

SerDes: The Data Highway System

What It Is: Serializer/Deserializer chips that convert parallel data streams into high-speed serial signals for transmission between chips and systems.

Why It’s Critical: SerDes technology represents the fundamental data transport layer for modern computing systems. Without efficient serialization, parallel processing architectures cannot scale effectively. Marvell’s 448 Gbps SerDes technology provides substantial bandwidth advantages over competing solutions.

Competitive Advantage: The company’s 1,000-engineer analog team has developed a roadmap exceeding 50 Tbps/mm, enabling higher data density with improved power efficiency compared to industry standards.

Optical DSPs: Converting Electricity to Light Speed

What It Is: Digital Signal Processors that convert electrical signals to optical (light-based) signals for ultra-high-speed, long-distance data transmission.

Why It’s Critical: Electrical interconnects face fundamental physics limitations in power consumption, heat generation, and signal integrity over distance. Optical solutions eliminate these constraints while enabling dramatically higher bandwidth.

Competitive Advantage: Marvell’s 3nm Ara 1.6 Tbps DSP achieves 20% power reduction while supporting 200 Gbps-per-lane fabrics, addressing the power and performance requirements of large-scale AI deployments.

Co-Packaged Optics (CPO): Bringing Light to the Chip

What It Is: Technology that integrates optical components directly onto the chip package, eliminating the need for separate optical modules.

Why It’s Critical: Traditional optical connections require discrete modules that add cost, complexity, and latency. CPO integration reduces these factors while improving signal integrity and system density.

Competitive Advantage: Eight years of silicon photonics development provides Marvell with proven manufacturing capabilities and extends transmission reach 100x beyond copper solutions while reducing latency.

Custom HBM Architecture: Smart Memory Design

What It Is: High Bandwidth Memory with custom compute architecture that optimizes how AI accelerators access memory.

Why It’s Critical: AI workloads are memory-bandwidth constrained. Standard memory interfaces create bottlenecks that limit system performance and increase power consumption.

Competitive Advantage: Marvell’s custom HBM reduces memory power consumption by 70%, increases die area efficiency by 25%, and supports 33% higher memory density per accelerator.

Advanced Packaging: The 3D Architecture Solution

What It Is: 2.5D/3D packaging technology that stacks and connects multiple chips in a single package using advanced interconnects.

Why It’s Critical: Traditional scaling through transistor shrinking has reached economic and physical limits. Advanced packaging enables continued performance scaling through architectural innovation.

Competitive Advantage: Marvell’s packaging toolkit provides design flexibility between proprietary and foundry solutions, mitigating supply chain constraints that limit competitors.

Package-Integrated Power (PIVR): Solving the Power Delivery Challenge

What It Is: Voltage regulators integrated directly into the chip package rather than placed on the circuit board.

Why It’s Critical: High-performance AI processors require precise power delivery with minimal losses. Board-level solutions create efficiency and thermal management challenges.

Competitive Advantage: PIVR technology doubles current density and reduces board losses by 85%, enabling 4kW+ AI platforms while maintaining thermal performance.

Switching Cost Analysis: Integration of Marvell’s proprietary IP into customer designs creates substantial switching costs, requiring 9+ months of re-qualification for alternative suppliers. This dynamic provides significant customer retention advantages in fast-moving markets.

Growth Catalysts: Revenue Expansion Opportunities

Custom XPU & Attach Pipeline

- Current Position: 18 sockets secured across top hyperscalers (5 XPUs, 13 attach)

- Market Expansion: 53% CAGR growth to $55B by 2028

- Market Share Target: 20% by 2028

- Revenue Implications: XPU sockets generate multi-billion lifetime revenue; Attach sockets provide multi-hundred million opportunities

Optical Connectivity Market Expansion

- Total Addressable Market (TAM) Growth: 35% CAGR to $19B by 2028

- Product Portfolio: 1.6T modules, CPO light engines, 200G/lane AEC DSPs

- Strategic Importance: Optical connectivity becomes essential as AI cluster sizes scale beyond copper interconnect capabilities

Strategic Partnership Portfolio

- NVIDIA NVLink Fusion: Enables hyperscaler integration of proprietary XPUs into NVIDIA rack-scale architectures

- UALink Consortium: Provides standards-based accelerator-to-accelerator mesh connectivity

- Market Impact: Expands addressable market without requiring proprietary platform development

Risk Assessment: Peers & Critical Vulnerabilities

Customer Concentration Risk (Primary Concern)

72% of accounts receivable concentrated among 5 customers represents significant revenue vulnerability. Customer diversification efforts remain insufficient to mitigate single-customer project delays or strategic shifts.

Margin Compression Pressures (Ongoing Challenge)

- Rising 3nm wafer costs

- HBM substrate cost inflation

- Optical ASP erosion trends

- Impact: GAAP gross margin guidance reduced from 60%+ to 59.5% range

Manufacturing Capacity Dependencies (Execution Risk)

Limited TSMC 3nm and CoWoS capacity allocation remains “earmarked” rather than long-term committed. Capacity constraints could compromise multi-generation design commitments to major customers.

Competitive Intensity (Market Share Risk)

- Broadcom scaling AI networking revenue at 39% YoY with superior cost structure

- Alchip gaining traction in Amazon Trainium3 development programs

- MediaTek and Credo entering 3nm optical DSPs with aggressive pricing strategies

Comprehensive Peer Analysis

| Metric | Marvell (MRVL) | Broadcom (AVGO) | NVIDIA (NVDA) | Credo (CRDO) |

|---|---|---|---|---|

| Revenue Growth | 63% YoY | 17% YoY | 29% YoY | 29% YoY |

| Data Center Growth | 76% YoY | 39% YoY | – | – |

| Gross Margin (GAAP) | 50% | 77-79% | ~70% | ~60% |

| R&D (% of Sales) | 29% | 15% | 22% | 22% |

| Forward P/E (FY27) | 16x | 37x | 34x | 25x |

Competitive Assessment: MRVL demonstrates fastest revenue acceleration but maintains structural margin disadvantages. The company trades at a significant valuation discount reflecting execution risks and competitive pressures.

Broadcom (AVGO): Market Leader

- Competitive Strengths: Superior operational margins, established scale advantages, diversified revenue base

- Strategic Limitations: Size constraints limit growth acceleration from emerging opportunities

- Market Relationship: Primarily complementary with selective competitive overlap

Credo (CRDO): Pure-Play Specialist

- Competitive Strengths: Focused optical connectivity portfolio, exceptional growth trajectory

- Strategic Limitations: Single-product concentration, limited scale advantages

- Market Relationship: Direct competitor in optical DSPs and AEC cable solutions

Recent Catalyst: The Custom AI Event That Changed Everything

June 17th’s custom AI event demonstrated Marvell’s strategic positioning in the accelerating AI infrastructure market.

Key Announcements:

- 2 new XPU design wins from hyperscalers (ramping 2026-2027)

- 12 additional XPU-Attach wins beyond Meta

- Total addressable market increased to $94B (+26% vs. last year)

- Reaffirmed 20% market share target by 2028

Strategic Analysis: The TAM expansion to $94B reflects genuine acceleration in AI infrastructure investment rather than marketing repositioning. The 2+12 new design wins represent multi-hundred-million to multi-billion-dollar lifetime revenue opportunities with high switching costs once implemented.

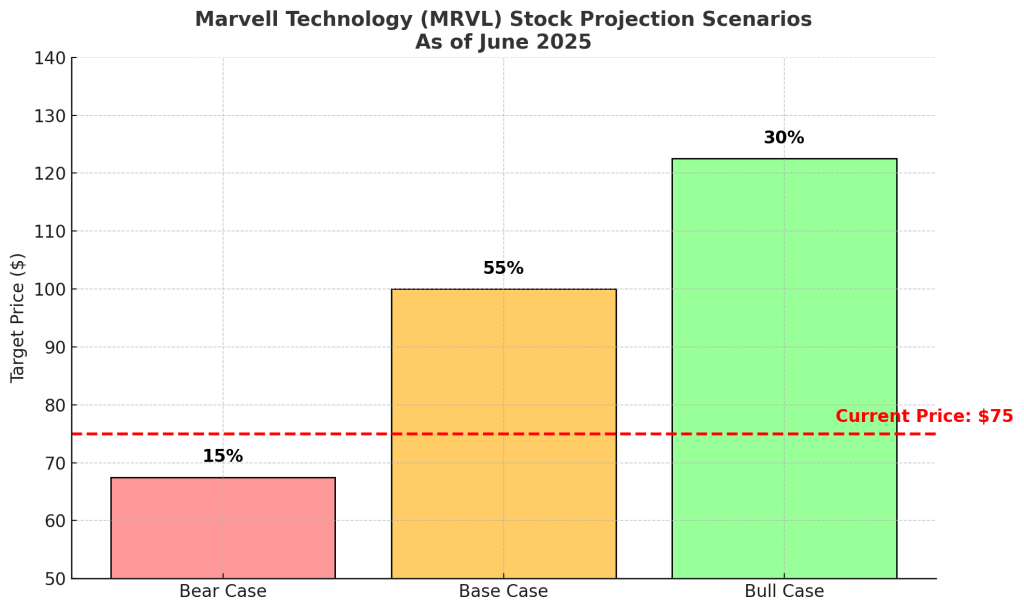

Investment Scenarios & Stock Probability Map (Current Price: $75)

| Scenario | Probability | Price Target | Upside/Downside |

| Base Case Steady adoption of AI silicon, stable customer retention, margin pressures managed effectively. | 55% | $95–$105 | +19% to +31% |

| Bull Case Rapid AI market penetration, substantial margin improvements, significant hyperscaler market share gains. | 30% | $115–$130 | +44% to +63% |

| Bear Case Heightened competition, execution delays, major customer disruptions, margin deterioration. | 15% | $65–$70 | -13% to -19% |

Investor Fit Matrix

| Investor Type | Fit Level | Strategic Recommendations |

| Growth Investors | ★★★★ | Aggressively accumulate during key product launches and earnings announcements; leverage call options for enhanced exposure. |

| Value Investors | ★★★ | Attractive valuation at 16x FY27 earnings; employ protective puts and value-based ETFs such as Vanguard Value ETF (VTV). |

| Income Investors | ★★ | Limited dividend appeal; deploy covered calls regularly to generate income; consider dividend-focused ETFs like iShares Core Dividend Growth ETF (DGRO). |

| Thematic Investors (AI Focus) | ★★★★ | Strong thematic alignment; position alongside AI-focused ETFs including Global X Artificial Intelligence ETF (AIQ), ARK Autonomous Technology & Robotics ETF (ARKQ), and VanEck Semiconductor ETF (SMH). |

Strategic Recommendations

- Employ hedging strategies to mitigate customer concentration risks.

- Capitalize strategically on margin-driven pullbacks as accumulation opportunities.

- Diversify semiconductor exposure to balance Marvell-specific operational risks.

Our Call: Marvell Technology remains significantly undervalued at current levels (~16x FY27 EPS). Its strategic shift to specialized AI infrastructure, strong pipeline of custom silicon projects, and established technology leadership support a BUY recommendation with a price target of $120 (24x FY27 EPS), reflecting substantial upside potential.