Strategic & Market Outlook

Disney (NYSE: DIS) maintains a powerful competitive position, driven by globally recognized intellectual properties such as Marvel, Star Wars, Pixar, National Geographic, and Disney classics like Mickey Mouse. This extensive ecosystem generates consistent, diversified revenue across theme parks, consumer products, and streaming services.

Nevertheless, Disney faces ongoing challenges from its linear television segment—traditional broadcast and cable TV—which continues to lose viewership to streaming alternatives. Networks such as ESPN and ABC remain profitable but face accelerating audience declines, regulatory pressures, and political sensitivities, increasing pressure for divestment.

Leadership succession is a significant area of risk, exacerbated by uncertainty around CEO Bob Iger’s eventual replacement. Historical transitions exposed strategic misalignments, highlighting the urgent need for a transparent and credible succession strategy to maintain investor confidence and operational coherence.

Competitive Positioning

- Brand Strength and IP: Disney’s major IP assets (Mickey Mouse, Marvel, Star Wars, Pixar, National Geographic) generate recurring high-margin revenues via merchandising, licensing, and multimedia content distribution.

- Streaming Market Position: Disney+ currently holds approximately 170 million subscribers versus Netflix’s 240 million, marking a significant market share gap. Disney+ differentiates with exclusive live sports content (ESPN) and unique original series but requires accelerated subscriber growth to meaningfully close this gap.

- Theatrical Revenue Volatility: High sensitivity to blockbuster releases such as “Avatar: Fire and Water” creates earnings volatility, underscoring the need for consistent theatrical success.

Industry and Peer Analysis

| Company | Strengths | Weaknesses | Disney Comparison |

|---|---|---|---|

| Netflix (NFLX) | Dominant streaming leader (~240M subscribers), extensive content slate | High production costs, limited revenue diversification | Disney trails in subscribers but has broader business segments beyond streaming. |

| Apple TV+ (AAPL) | Premium content quality, strong financial backing | Modest subscriber count (~50M), ineffective subscriber growth strategies | Disney has superior subscriber scale and diversified content ecosystem. |

| Comcast (CMCSA) | Effective divestment from linear TV, strong broadband and parks | Reliance on shrinking linear segment | Similar linear challenges as Disney but fewer high-value IP assets. |

| Warner Bros. Discovery (WBD) | Rich content library (HBO, Max), aggressive shift to digital | Complex restructuring, heavy linear TV exposure | Disney has stronger IP and more stable revenue diversification. |

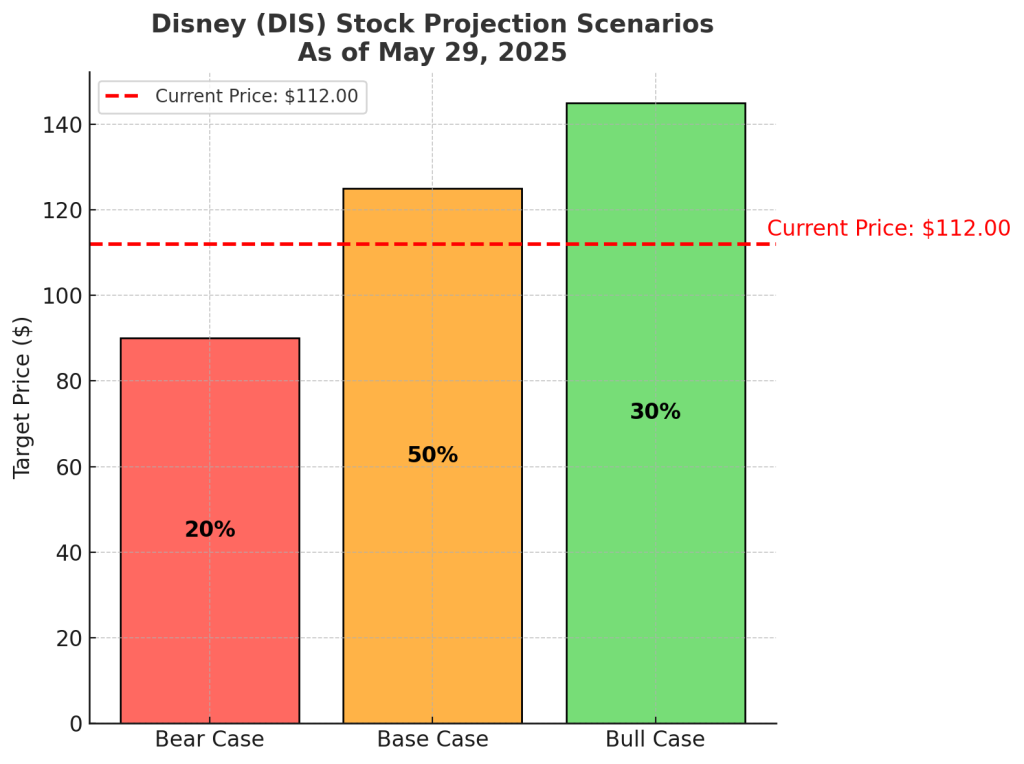

Investment Scenarios & Stock Probability Map

Current Price: $112 (as of today)

| Scenario | Probability | Price Target |

| Base Case Moderate subscriber growth (~180M), gradual recovery in parks, managed linear TV declines, stable consumer product performance | 50% | $125.00 |

| Bull Case Successful leadership transition, strong subscriber growth (200M+), significant expansion in gaming, strong parks performance. | 30% | $145.00 |

| Bear Case Prolonged leadership uncertainty, rapid linear TV erosion, underperformance in theatrical releases, limited subscriber growth (~175M). | 20% | $90.00 |

Investor Fit Matrix (with Strategic Positioning)

| Investor Type | Fit Level | Commentary |

| Growth-Oriented | ★★★ | Strong fit. Disney’s aggressive expansion into streaming and potential growth in gaming through strategic IP utilization provide attractive opportunities. Pair with other growth platforms (NFLX, ROKU) for diversified exposure. |

| Deep Value | ★★☆ | Moderate fit. Current valuation (Forward P/E ~19x, P/S ~2.2x, EV/EBITDA ~14x) reflects moderate attractiveness; potential revaluation contingent on successful leadership succession and linear divestiture. Cautiously hedge positions with lower-risk media peers. |

| Momentum Trader | ★★★ | Excellent fit. Anticipated succession announcements and high-impact theatrical releases offer significant short-term trading opportunities. Leverage tactical option strategies (e.g., straddles, spreads) around these events. |

| Risk-Off/Income Seeker | ★★☆ | Limited fit. Modest dividend yield (~1%) and volatility from linear TV decline reduce attractiveness. Complement Disney holdings with dividend-rich, stable stocks or income-oriented ETFs for balance. |

| Media & Entertainment Thematic | ★★★ | High fit. Disney’s extensive and iconic IP, content portfolio, and multi-platform distribution strongly align with thematic investors seeking exposure to global media and entertainment trends. |

Investment Opportunities

- Streaming Subscriber Growth: Analyze Disney’s subscriber acquisition strategy, particularly potential gains from ESPN sports integration.

- Linear TV Asset Divestment: Monitor divestment strategies closely for potential operational streamlining and risk reduction.

- Leadership Succession Clarity: Carefully evaluate succession developments given their potential for significant strategic shifts and investor sentiment impact.

- Gaming Market Expansion: Identify growth opportunities from leveraging iconic IP within the rapidly expanding gaming sector.

Our Call: Disney’s diversified, IP-centric business model remains compelling, despite risks from linear TV and succession uncertainties. Current valuation metrics suggest moderate attractiveness. Recommend strategic accumulation during volatility linked to leadership succession and theatrical uncertainties, emphasizing Disney’s enduring franchise strength and thematic investment appeal.