Investology Equity Research

Investment Thesis

Netflix has transitioned from hypergrowth disruptor to dominant, global-scale cash-flow generator. Following a period of overspend and post-pandemic correction, the company has rationalized its content slate, improved monetization via pricing and ad tiers, and reinforced its global lead. While Amazon (AMZN), Apple (AAPL), and Disney (DIS) remain competitive, Netflix’s global scale, brand equity, and operational discipline make it the best-positioned player in the direct-to-consumer (DTC) streaming market. We view NFLX as a long-term compounder with upside tied to margin expansion and international ARPU growth.

Financial & Strategic Highlights

| Metric | 2023 | 2024E | Commentary |

|---|---|---|---|

| Global Subscribers | 260M | ~285M | Driven by crackdown on password sharing and growth in LATAM, APAC |

| Operating Margin | 21% | 23–24% | Recovered from 18% in 2022 post-pandemic spending cuts |

| Free Cash Flow (FCF) | $6.9B | $8–9B | Positive and accelerating, a rarity among streaming peers |

| Ad-Supported Tier ARPU | > Ad-free | Growing | Supported by better CPMs and low churn |

Moat & Positioning

Category Leadership

- Netflix is the only global, pure-play DTC streaming business with scale across >190 countries.

- While competitors treat streaming as a division, Netflix has 100% focus, enabling faster iteration and strategic clarity.

Content Discipline

- Transitioned from “movie-a-week” bloat to a curated, performance-driven content strategy.

- Consolidation of animation and family content divisions has reduced low-ROI investments.

- Increasing focus on high-return IP and international originals (notably Korean dramas, Indian and Spanish-language markets).

Live & Event-Based Content

- Entering live “event television” (e.g. Tyson vs. Paul fight) for engagement spikes and monetization tests.

- Unlikely to pursue major sports rights, preserving capital efficiency.

Risks & Competitive Threats

Primary Competitors

| Peer | Strengths | Weaknesses |

| Amazon (AMZN) | Deep pockets, MGM library, global reach, theatrical window | Streaming not core biz; UI confusion persists |

| Apple (AAPL) | Premium brand, award-winning content | Lack of scale, uncertain strategic commitment, minimal content output |

| Disney (DIS) | IP depth (Marvel, Star Wars, Pixar), family lock-in | Subscale in adult content, margin compression, pivot back to theatrical |

Second-Tier Threats

- Paramount+, Peacock, HBO Max: Domestic-focused, lower budgets, specialized audiences.

- Industry consolidation is likely; smaller services risk being bundled, absorbed, or sunset altogether.

Macro & Platform Risks

- Churn sensitivity if content pipeline misfires or price hikes exceed perceived value.

- Ad-tier cannibalization risk if subscriber migration lowers ARPU, though early signs are positive.

- Content arms race re-escalation if Amazon/Apple return to high-burn acquisition mode.

Strategic Catalysts

- Ad-Supported Monetization: NFLX is extracting higher ARPU from ad-supported users than traditional subscriptions—a major differentiator in unit economics.

- International Content Expansion: Focused growth in Korean, Indian, and Spanish-language content to tap under-penetrated markets.

- Event-Based Monetization: Live programming used selectively to generate spikes in engagement without long-term rights liabilities.

- Ongoing Margin Expansion: Content spending discipline + operational leverage = potential for OPM to exceed 25% by 2026.

What’s Not Working

- Gaming Push: Remains a non-starter. Casual mobile games failed to gain traction; Netflix lacks both IP and platform capabilities to compete.

- Interactive Content: Quietly sunset. High cost, low engagement.

- Theatrical Releases: Netflix continues to prioritize platform-first strategies despite creator pressure.

Valuation & Outlook

NFLX trades at a premium multiple (30–35x forward earnings), which we believe is warranted given its FCF yield, global scale, and superior margins vs. peers. While near-term upside is tied to ad-tier ramp and subscriber growth, long-term upside is driven by pricing power and continued margin expansion.

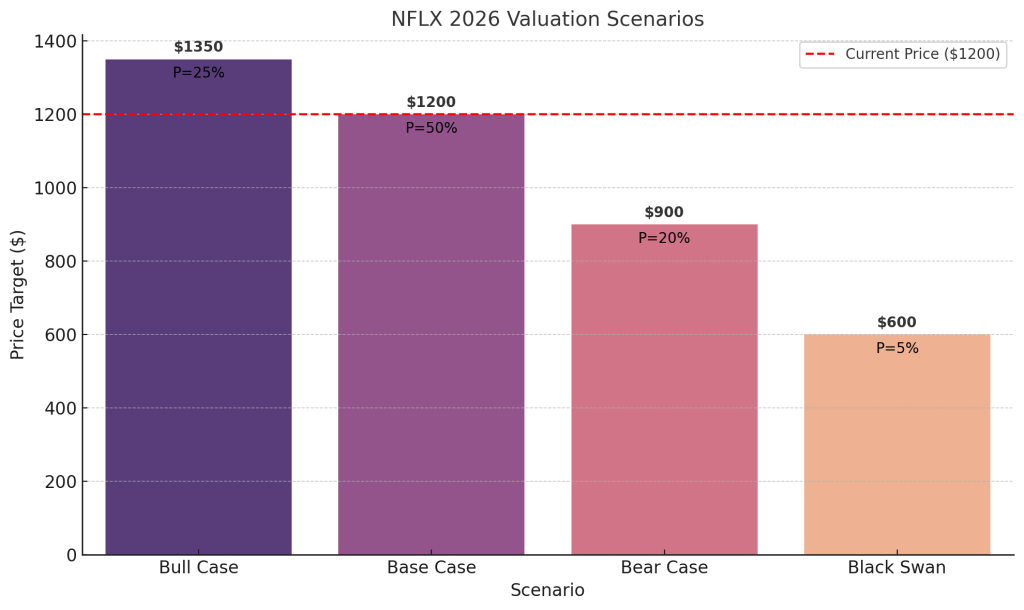

Valuation Probability Map

| Scenario | Price Target | Probability | Narrative |

| Bull Case | $1350 | 25% | Ad-tier scales globally, content wins, margins expand ahead of plan. |

| Base Case | $1200 | 50% | Disciplined growth continues, pricing power drives modest upside. |

| Bear Case | $900 | 20% | Macro headwinds or content fatigue reduce engagement and sub growth. |

| Black Swan | $600 | 5% | Regulatory or platform-level disruption triggers rapid market repricing. |

Investor Style Fit

Growth Investors:

NFLX remains highly attractive due to global scale, ARPU growth via ads, and reinvestment efficiency.

Core Compounders / Quality-Focused:

High ROIC, brand strength, and subscriber stickiness make Netflix a rare tech-style compounder in media.

Risk-Off / Defensive Investors:

May hesitate at current valuation given volatility risk tied to competition and reliance on discretionary content consumption. Consider pairing with dividend-rich legacy media (e.g., CMCSA) or broad consumer staples ETFs for volatility hedging.

Deep Value / Distressed: NFLX isn’t a turnaround or undervalued play. Consider long positions in WBD or PARA, and potentially short NFLX as a hedge against legacy TV decline.

Diversification Ideas:

- Blend with AMZN for broader exposure to retail/media convergence.

- Pair with DIS or WBD to play different IP monetization strategies.

- Hedge content exposure by adding infrastructure (e.g., CDNs, data center REITs like EQIX) to reduce platform volatility dependency.

Bottom Line

Netflix is evolving from a growth-at-any-cost disruptor into a disciplined, margin-driven platform with global reach. Its scale advantage, diversified content engine, and early traction in ad-supported monetization distinguish it from peers still navigating identity crises. With rationalized spending and expanding FCF, Netflix is positioned to outperform in both growth-led and margin-aware market environments. Among DTC streamers, it stands alone in balancing content breadth, user loyalty, and platform economics.

Rating: Buy

Conviction: High