Investology Equity Research

Investment Summary

Amazon (NASDAQ: AMZN) is responding to rising tariffs with surgical agility. Instead of absorbing the blow or reshoring, it’s rerouting Chinese goods through tariff-friendly Asian countries, leveraging white-label manufacturing in Vietnam and Thailand to sidestep U.S. trade barriers. The result: lower effective tariffs, limited disruption, and a more nimble global supply chain.

But that workaround isn’t without friction – rising holding costs, geopolitical scrutiny, and a fragmenting e-commerce landscape are putting pressure on Amazon’s margins. Traditional fast-moving consumer goods (FMCG) peers like Unilever (NYSE: UL) and Procter & Gamble (NYSE: PG) are even more exposed, weighed down by inflexible supply chains and outdated brand portfolios.

Key Takeaways

- 80% of Amazon’s goods are sourced locally in many markets (e.g. UAE, Saudi Arabia), enabling rapid reaction to tariffs and demand changes.

- China’s demographic and labor headwinds are pushing Amazon to diversify manufacturing to Vietnam, Thailand, and potentially Indonesia.

- White-label routing of Chinese products through third countries is Amazon’s go-to workaround – using finishing touches in lower-tariff countries to mask origin.

- Traditional FMCG companies are being disrupted by local, sustainable, and niche brands as consumers shift toward organic and ethically sourced products

- Amazon’s e-commerce moat is narrowing as fragmentation increases, with niche platforms specializing in single product verticals gaining traction.

Amazon’s Strategic Response: White-Labeling & Diversification

Amazon’s response to persistent tariffs is as pragmatic as it is cunning:

- Chinese goods are semi-finished and shipped to low-tariff countries like Vietnam and Thailand, where finishing touches are applied before reaching the U.S.A

- This “white-label” strategy reduces tariff exposure and satisfies rules-of-origin regulations without requiring a full relocation of manufacturing.

But:

- CapEx pressure is real. Setting up finishing hubs – even minimal ones – adds holding costs and operational complexity.

- Regulatory optics may sour. U.S. policymakers could tighten scrutiny of origin-based tariff dodging.

Impact on Traditional FMCG Companies (UL, PG) – And Why It Matters for AMZN

Legacy fast-moving consumer goods (FMCG) companies like Unilever (NYSE: UL) and Procter & Gamble (NYSE: PG) are caught in a bind: global trade friction is squeezing their input costs, while shifting consumer preferences and agile competition are eroding their moat.

Key Weaknesses in FMCG Models:

- Heavy reliance on imported raw materials (e.g. chemicals, packaging, fragrance oils from China and India), leaving them highly exposed to tariffs and supply disruptions.

- CapEx-heavy supply chains with 10–12 year ROI cycles make it hard to pivot quickly. These firms can’t “right-size” operations the way Amazon can shut a warehouse or reroute a product.

- Legacy brands lack appeal to younger consumers demanding organic, sustainable, and locally sourced products. Modern DTC (direct-to-consumer) upstarts are eating their lunch, especially in categories like skincare, home cleaning, and nutrition.

Portfolio Bloat & Strategic Inertia:

Even when FMCG giants acquire smaller trend-aligned brands, they struggle to integrate them efficiently:

- Their pricing models and logistics systems are built for mass retail, not the fast-cycle, high-margin e-commerce landscape.

- Brand dilution risk looms when a conglomerate buys an indie darling but fails to maintain its authenticity or edge.

Amazon’s Contrasting Advantage:

This sets up Amazon for both defensive and offensive positioning:

| Advantage | Why It Matters |

|---|---|

| Supply chain elasticity | Amazon can shift sourcing or fulfillment footprint in weeks, not years. |

| Platform power | Many DTC brands now launch on Amazon to scale, even as they seek to diversify. Amazon earns either way. |

| Private label & white-label agility | Amazon Basics and Solimo can rapidly mimic FMCG products at lower cost and higher margin, especially in commoditized categories. |

| Data flywheel | Amazon’s shopper behavior data helps it predict consumer shifts before FMCG giants can adjust production or launch cycles. |

Strategic Insight:

If Amazon accelerates its white-label and private-brand efforts – especially in health, personal care, and home goods – it could begin directly replacing incumbent FMCG products on its own platform. Combined with its fast-evolving fulfillment model, Amazon is poised to cut into FMCG share while simultaneously hosting their competitors.

Margin Pressure Ahead for Amazon

While Amazon’s short-term solution is tactically sound, the underlying business faces pressure:

| Pressure Point | Impact |

|---|---|

| Increased holding & routing costs | Compresses fulfillment margins |

| Slow diversification away from China | Long runway for meaningful change |

| Marketplace disintermediation | Brands increasingly prefer owning CX |

| Regulatory heat on white-label tactics | Risk of retroactive tariffs or fines |

Fragmentation: E-Commerce is Unbundling

The age of “Amazon for everything” is cracking. New trends:

- Rise of specialized e-commerce players – think niche skincare, high-end organic, or locally branded marketplaces.

- Sellers are treating Amazon as a channel, not a home – avoiding AMZN’s fees and rules where possible.

- Asian players (e.g., Trendyol, Hepsiburada) are rising – many funded or backed by Chinese capital using localized brands and infrastructure.

Expect further fragmentation across e-commerce. The future is multi-channel, micro-brand, and highly targeted.

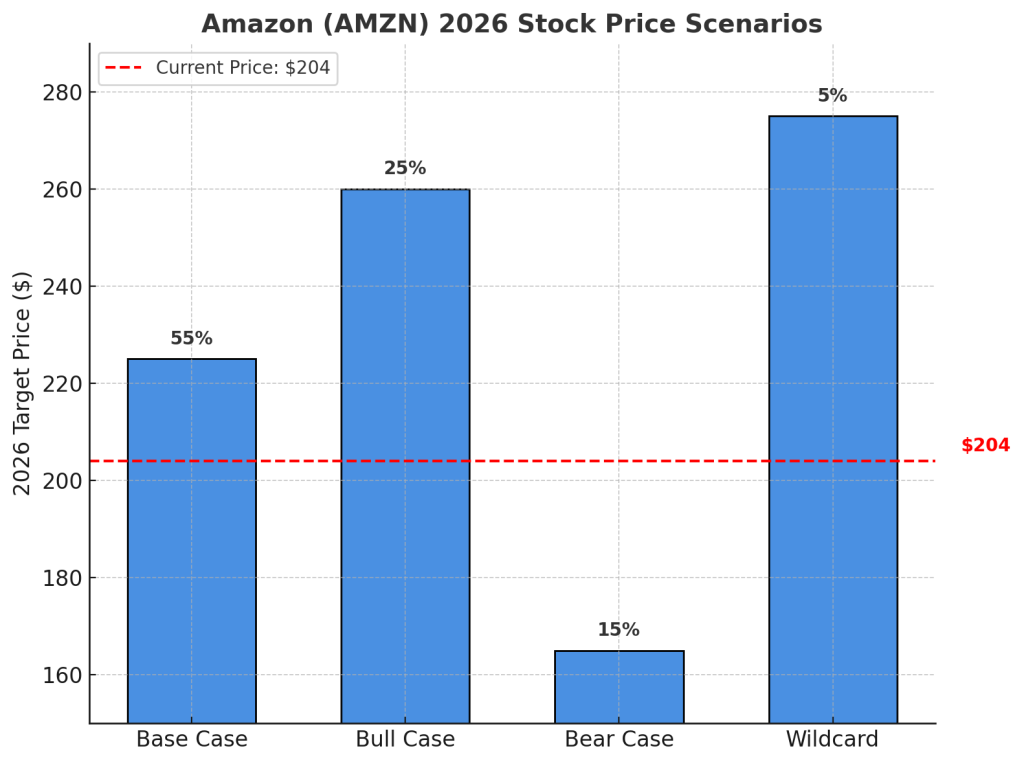

Stock Probability Map

| Scenario | Probability | 2026 Price Target | Assumptions |

|---|---|---|---|

| Base Case: White-labeling works, margins compressed | 55% | $225 | Steady top-line, mid-teen margin squeeze |

| Bull Case: Trade tensions ease, low fulfillment inflation | 25% | $260 | Growth accelerates, cost pressures ease |

| Bear Case: U.S. cracks down on supply routing | 15% | $165 | Tariff circumvention curbed, restructuring required |

| Wildcard: Logistics/fulfillment business is spun out | 5% | $275+ | Asset unlocking, investor re-rating |

Current Price: $204 (as of May 20, 2025)

Investor Style Fit

| Investor Style | Fit | Approach |

|---|---|---|

| Growth | ✅ Good | Focus on AMZN’s ability to scale new regional logistics and fulfillment markets; white-labeling is a short-term buffer |

| Value | ⚠️ Cautious | Be selective. Consider valuation only if margin compression stabilizes and new segments (e.g., Ads, AWS) outperform |

| Defensive | ❌ Poor | Highly exposed to trade, currency, and policy volatility; better alternatives include Costco (NASDAQ: COST) or UPS (NYSE: UPS) |

| ESG / Thematic | ❌ Weak | Amazon’s labor and emissions profile lags. Consider Shopify (NYSE: SHOP) or sustainable DTC aggregators |

Bottom Line

Amazon is not panicking – it’s pivoting. While white-labeling Chinese goods via Vietnam isn’t a long-term fix, it reflects Amazon’s core strength: strategic elasticity. But margin headwinds, marketplace fragmentation, and regulatory overhang suggest the real challenge is just beginning.

If Amazon wants to remain the everything store, it will need to become the everywhere operator – regionally diversified, platform-agnostic, and margin-aware.