NVIDIA remains the undisputed AI king, but at $158 vs. our $140 fair value target, the market is pricing in perfection while AMD’s MI300 series and hyperscaler custom chips make this game more competitive than ever. Meanwhile, Broadcom quietly captures 20% of AI infrastructure spend as the unsung kingmaker.

Executive Summary: When You’re This Good, Everyone Wants to Take You Down (And Pay a Premium)

NVIDIA Corporation (NASDAQ: NVDA) continues to dominate the AI revolution with the subtlety of a sledgehammer, posting Q1 FY2026 revenue of $44.1 billion (+69% YoY) while maintaining gross margins that would make luxury handbag companies jealous at 61%. But here’s the plot twist: the stock now trades at $158, representing a 13% premium to our $140 fair value estimate.

The Bottom Line: At a 1.13 price-to-fair-value ratio, NVIDIA has moved from “reasonably priced dominance” to “priced for continued perfection” territory. This isn’t necessarily a sell signal, but it definitely changes the risk-reward equation—especially when Broadcom (NASDAQ: AVGO) offers similar AI exposure at more attractive valuations.

New Data Points: The Supply Chain Tells a Story

The latest Taiwanese supply chain intelligence and additional research provide fascinating insights into NVIDIA’s production momentum and market dynamics:

GB200 Production Acceleration

According to industry channel checks, GB200 shipments are ramping faster than expected:

- Q1 2025 Actual: 1.5k units (700 from Quanta, 500 from Hon Hai, 300 from Wistron)

- Q2 2025 Revised: 7.2k units (up from 6k estimate)

- Full Year 2025: 32k units total (27k NVL72 + 5k NVL36)

What This Means: NVIDIA’s premium GB200 systems are seeing strong enterprise adoption, supporting our thesis about infrastructure spend acceleration.

HGX B200 Demand Surge

Post-DeepSeek launch, traditional HGX B200 products are seeing renewed interest:

- Total B200 GPU Output 2025: 5.1 million units

- Rack Capacity: Only 4 million can be processed into racks within 2025

- Market Split: 60% GB200 vs 40% traditional HGX (shifting from 66%/34%)

Translation: Even with GB200 success, demand for traditional AI servers remains strong, indicating broad-based AI adoption.

The TAM Reality Check: Think Bigger Than Traditional Estimates

Recent research makes a compelling case that traditional Total Addressable Market (TAM) estimates are woefully inadequate for NVIDIA’s opportunity:

“Jensen Math” – The Power Equation

NVIDIA’s latest framework suggests:

- Every Gigawatt of AI Infrastructure = $40-50B Revenue Opportunity

- 2025-2030 Power Demand: Growing from 44 GW to 156 GW (30% CAGR)

- Cumulative 5-Year Opportunity: ~$5 trillion

Market Share Reality

If we accept this framework, NVIDIA capturing even 40% of a $2+ trillion annual market by 2029 isn’t unrealistic—it’s infrastructure company scale thinking.

Our Take: This reframes the valuation debate. At $158, NVIDIA isn’t just expensive relative to traditional semiconductor metrics – it’s potentially cheap relative to infrastructure utility multiples.

The CUDA Moat: Still Deeper Than the Mariana Trench

Let’s address the elephant in the room – or should we say, the 10,000+ companies in NVIDIA’s partner network. The CUDA ecosystem isn’t just a competitive advantage; it’s basically the Death Star of software platforms, and unlike its Star Wars counterpart, this one doesn’t have a convenient exhaust port.

Why CUDA Still Rules:

- Developer Productivity Gap: Tasks taking 4-5 weeks on AMD’s ROCm platform complete in just 1 week on CUDA

- Network Effects: Over 10,000 companies deeply integrated into the ecosystem

- Switching Costs: Years of code optimization and developer training create massive friction

- Performance Edge: Up to 100% performance improvements through software optimizations alone

Financial Performance: Numbers That Make CFOs Weep (With Joy)

Revenue Breakdown: Data Center Dominance

- Total Q1 FY2026 Revenue: $44.1B (+69% YoY, +12% sequential)

- Data Center: $39.1B (89% of total, +73% YoY)

- Gaming: $3.8B (+48% sequential, +42% YoY)

- Automotive: $567M (+72% YoY)

Blackwell Transition Success

- Blackwell Contribution: 70% of Data Center compute revenue in Q1

- Architecture Mix: Rapid transition from Hopper completed

- GB300 Samples: Already shipping to major cloud providers

Supply Chain Validation: The Taiwanese ODM data confirms this transition is real and accelerating, with major partners like Quanta, Wistron, and Hon Hai all ramping production.

Profitability Metrics That Defy Gravity

- Gross Margin: 61.0% (71.3% excluding H20 inventory charge)

- Operating Margin: 53%

- ROE: >90%

- ROA: >65%

- Free Cash Flow: Strong enough to return $14.3B to shareholders

Broadcom: The Most Underappreciated AI Play in the Market

While everyone obsesses over the NVIDIA vs. AMD battle, Broadcom (AVGO) has quietly become the most essential AI infrastructure company nobody talks about. This isn’t just a networking play, it’s a comprehensive AI infrastructure empire hiding in plain sight.

AVGO’s AI Revenue Reality Check

- AI-Related Revenue: $12.2B annually (nearly 30% of total revenue)

- Growth Rate: 220% YoY in AI segments

- Market Position: Essential infrastructure in 90%+ of AI deployments

The Three Pillars of Broadcom’s AI Dominance

1. Networking Infrastructure (The Plumbing)

- Tomahawk Switches: 80%+ market share in AI data center networking

- Jericho Routers: Backbone of hyperscaler infrastructure

- NIC Revenue: $3B+ annually from network interface cards

Why This Matters: Every GPU cluster needs Broadcom networking. Whether it’s NVIDIA H100s or AMD MI300Xs, they all connect through AVGO switches. It’s like owning the highways while everyone argues about the cars.

2. Custom ASIC Design (The Secret Weapon)

- Google TPU: Broadcom designs and manufactures Google’s AI chips

- Meta MTIA: Custom silicon for Facebook’s recommendation engines

- AWS Partnerships: Trainium and Inferentia chips designed by AVGO

- Revenue Scale: $4B+ annually from custom AI silicon

The Competitive Angle: While NVIDIA fights to keep hyperscalers as customers, Broadcom helps them become competitors. Every custom ASIC that Broadcom designs is potential revenue taken from NVIDIA.

3. Infrastructure Software (The Control Layer)

- VMware Integration: Enterprise AI workload management

- Network Operating Systems: Software that makes AI clusters work

- Security Solutions: Critical for enterprise AI deployments

Valuation Arbitrage: Why AVGO Looks Cheap vs. NVIDIA

AVGO vs. NVDA Metrics:

| Company | Market Cap | P/E (Forward) | AI Revenue | AI Growth | Gross Margin |

|---|---|---|---|---|---|

| NVIDIA | ~$3.9T | 27x | ~$170B | 70% | 61% |

| Broadcom | ~$680B | 24x | ~$12B | 220% | 73% |

The Math That Matters:

- NVIDIA AI Revenue Multiple: 23x revenue

- Broadcom AI Revenue Multiple: 57x revenue

Wait, that seems backward. But here’s the key insight: Broadcom’s AI business is earlier in its scaling curve. If AVGO reaches just $50B in AI revenue (plausible given infrastructure necessity), at NVIDIA’s multiple that’s worth $1.15 trillion – 70% upside from current levels.

Why Broadcom’s Moat is Actually Deeper Than NVIDIA’s

Network Effects:

- Infrastructure Stickiness: Replacing data center networking is a 3-5 year project

- Switching Costs: Higher than GPU switching costs (measured in hundreds of millions)

- Integration Complexity: Deep partnerships with every major cloud provider

Technology Leadership:

- Next-Gen Networking: 800G Ethernet leadership

- Custom Silicon: One of only three companies capable of hyperscaler-scale ASIC design

- Software Integration: VMware acquisition created comprehensive stack

Customer Diversification:

- No Single Customer >15% of Revenue: Unlike NVIDIA’s hyperscaler concentration

- Infrastructure Necessity: Customers can’t eliminate networking, only choose vendors

- Cross-Platform: Benefits from both NVIDIA and AMD AI deployment growth

Competitive Landscape: The Three-Way Battle Everyone Misses

The Real AI Infrastructure Stack

Most investors think AI competition is NVIDIA vs. AMD. The reality is more complex:

Layer 1: Compute (The Headline Battle)

- NVIDIA: 70-80% market share, premium pricing

- AMD: 15-20% share, cost leadership in inference

- Custom ASICs: 10-15%, specialized workloads

Layer 2: Networking (Broadcom’s Kingdom)

- Broadcom: 80%+ market share

- Cisco: 15% (legacy enterprise)

- Others: 5% (niche players)

Layer 3: Software/Management (The Future Battleground)

- NVIDIA: CUDA ecosystem dominance

- Broadcom: VMware + networking OS

- Cloud Providers: Kubernetes, custom orchestration

AMD: The Credible Challenger Finally Emerges

Why AMD’s Challenge is Different This Time:

- MI300 Series Traction: Gaining adoption at Microsoft, Oracle, and Meta

- Data Center Growth: 57% YoY revenue increase

- Customer Diversification: Hyperscalers seeking NVIDIA alternatives for pricing leverage

- Technical Competence: Memory advantage in inference workloads

AMD’s Path Forward:

- Focus on inference workloads where switching costs are lower

- Leverage cost advantages to win price-sensitive customers

- Build developer ecosystem (the long game)

Reality Check: AMD is making progress, but going from 0% to meaningful market share against NVIDIA is like trying to become TikTok famous while Instagram exists – possible, but you need something truly special.

The Hyperscaler Custom ASIC Threat

Google’s TPU Evolution:

- TPU v5e offers competitive inference performance

- Estimated 3-5x better cost-performance for specific workloads

- Broadcom Connection: AVGO designs and manufactures TPUs

AWS Trainium/Inferentia Impact:

- 40% cost reduction vs. NVIDIA for specific inference tasks

- Broadcom Connection: AVGO partnership on chip design and manufacturing

Meta’s MTIA Strategy:

- Custom silicon for recommendation engines

- Broadcom Connection: AVGO provides design services and networking

The Irony: Broadcom benefits from both NVIDIA’s success AND the custom ASIC threat to NVIDIA. It’s like selling arms to both sides of a war.

Updated Growth Drivers: The Supply Chain Validates the Narrative

Data Center AI Infrastructure Expansion

Recent supply chain data confirms management projections:

- CSP Deployment Rate: Nearly 1,000 NVL72 cabinets per week

- Microsoft Scale: Tens of thousands of Blackwell GPUs deployed

- Token Processing: 100+ trillion tokens in Q1 (5x YoY growth)

Oracle Demand Example: New 500 racks per month contract starting August 2025, demonstrates sustained enterprise adoption.

Gaming Recovery Acceleration

- Q1 Gaming Revenue: $3.8B (+48% sequential)

- Blackwell Gaming: Achieved “fastest ramp ever”

- Nintendo Partnership: Switch 2 with custom RTX architecture

China Impact: Quantified but Manageable

- Immediate Impact: $8B Q2 loss from H20 restrictions

- Long-term Impact: ~$50B over multiple years

- Mitigation: Sovereign AI in 18 countries provides alternative growth

Valuation Analysis: Premium Territory (But Is It Justified?)

Current Metrics:

- Trading Price: $158

- Our Fair Value: $140

- Price-to-Fair-Value: 1.13 (13% premium)

- Implied P/E (Forward): ~27x

- Market Cap: ~$3.9 trillion

Peer Comparison with AI Focus:

| Company | Market Cap | P/E (Forward) | AI Revenue | AI Multiple | Position |

|---|---|---|---|---|---|

| NVIDIA | ~$3.9T | 27x | ~$170B | 23x | Compute leader |

| Broadcom | ~$680B | 24x | ~$12B | 57x | Infrastructure |

| AMD | ~$240B | 31x | ~$8B | 30x | Challenger |

| Intel | ~$100B | 18x | ~$1B | 100x | Laggard |

| Qualcomm | ~$180B | 16x | ~$3B | 60x | Edge specialist |

The Broadcom Arbitrage Opportunity

Why AVGO Looks Cheap:

- Lower AI Revenue Multiple: Despite higher growth rates

- Infrastructure Necessity: More defensive than pure compute exposure

- Diversification: Benefits from all AI vendors, not just NVIDIA

- Margin Profile: 73% gross margins rival NVIDIA’s software leverage

AVGO Upside Scenario: If Broadcom reaches $25B in AI revenue by 2027 (conservative given infrastructure necessity), at NVIDIA’s 23x multiple, that values the AI business alone at $575B—nearly current total market cap.

Risk Assessment: Premium Prices, Premium Risks

Near-Term Risks (Amplified by Valuation):

- China Restrictions: $50B long-term revenue impact confirmed

- AMD Competitive Pressure: MI300X wins translating to pricing pressure

- Supply Chain Concentration: Heavy dependence on Taiwan ODMs

- Margin Pressure: Any decline from 70%+ levels hits premium valuations hard

Competitive Risks:

- Custom ASIC Adoption: Hyperscalers reducing dependency could accelerate

- AMD Inference Gains: Targeting NVIDIA’s fastest-growing segment

- Geopolitical Tensions: Taiwan supply chain creates systemic risk

Bull Case Justification at $158:

- Infrastructure Utility Status: If NVIDIA becomes AI infrastructure backbone, current valuation justified

- TAM Expansion: Multi-trillion dollar opportunity supports premium

- CUDA Durability: Software moat may prove deeper than hardware competition

- Innovation Pace: NVIDIA’s R&D advantage could maintain technology leadership

Investment Thesis: Portfolio Strategy for the AI Revolution

Why We Maintain HOLD on NVIDIA at $158:

The Reinforced Good:

- Supply chain data validates exceptional demand

- Infrastructure-scale opportunity emerging

- CUDA moat proving durable under pressure

- Production ramp exceeding expectations

The Concerning:

- 13% premium to fair value with limited margin of safety

- China revenue loss larger than expected ($50B)

- AMD and custom ASICs gaining traction in inference

- Competition timing coinciding with premium valuation

The Better AI Investment Case: Broadcom

Why AVGO Deserves Serious Consideration:

1. Valuation Arbitrage:

- Similar growth rates to NVIDIA at lower multiples

- Infrastructure necessity provides downside protection

- Earlier in scaling curve with massive upside potential

2. Competitive Positioning:

- Benefits from ALL AI infrastructure deployment

- Deeper moat than compute vendors (networking infrastructure)

- Custom ASIC business grows whether or not it hurts NVIDIA

3. Financial Profile:

- 73% gross margins rival NVIDIA

- Diversified revenue base reduces customer concentration risk

- Strong free cash flow generation supports dividend growth

Our Updated Investment Recommendations:

NVIDIA (NVDA): HOLD – $140 Fair Value

- Phenomenal company at full valuation

- Risk-reward shifted unfavorably at $158

- Consider trimming positions above $160

Broadcom (AVGO): BUY – $185 Fair Value

- Most underappreciated AI infrastructure play

- Valuation arbitrage vs. NVIDIA compelling

- Benefits from AI growth regardless of compute vendor winner

AMD (AMD): BUY – $165 Fair Value

- Credible technical challenge to NVIDIA emerging

- Asymmetric risk-reward in inference markets

- Reasonable valuation relative to opportunity

Portfolio Strategy for AI Exposure:

- Core Position (40%): Diversified across NVDA/AVGO/AMD

- NVIDIA: Maintain but don’t add at current levels

- Broadcom: Underweight position offers best risk-adjusted returns

- AMD: Small position for asymmetric upside

An analogy for the more experienced: Think of this like investing in the internet in 1999. NVIDIA is like Cisco- clearly the leader but priced for perfection. Broadcom is like buying the fiber optic cable companies – less exciting but more essential. Sometimes the best AI play isn’t the obvious one.

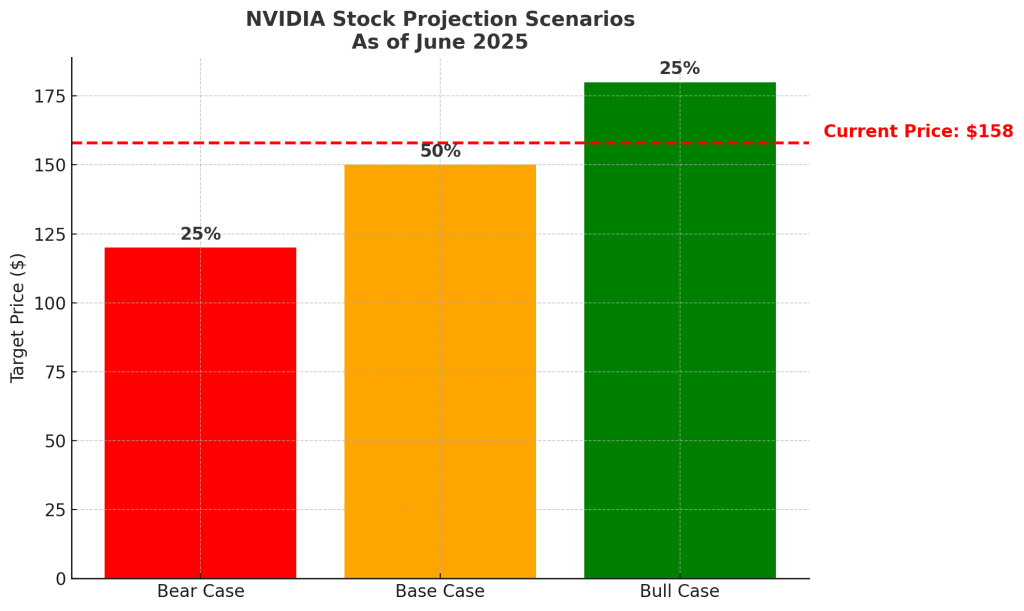

Investment Scenarios & Stock Probability Map

| Scenario | Probability | Price Target | Upside/Downside |

| Bull Case Continued AI infrastructure dominance; GB200 ramps exceed expectations; broad-based enterprise adoption; CUDA moat remains impenetrable. | 25% | $180+ | +14% or higher |

| Base Case Sustained leadership with incremental market share erosion to AMD and custom ASICs; stable CUDA ecosystem advantage; manageable China headwinds. | 50% | $140-160 | -11% to +1% |

| Bear Case Accelerated competition from AMD and custom hyperscaler ASICs; significant margin pressure from pricing battles; expanding geopolitical risks affecting supply chain. | 25% | $120 | -24% |

Investor Fit Matrix

| Investor Type | Fit Level | Strategic Recommendations |

|---|---|---|

| Growth Investors | ★★★★☆ | Accumulate around product launches and earnings; leverage call spreads to manage risk and upside potential. |

| Value Investors | ★★☆☆☆ | Rich valuation reduces appeal; use protective puts or diversify into lower-priced AI infrastructure plays (e.g., AVGO). |

| Income Investors | ★☆☆☆☆ | Limited yield and high valuation; deploy covered calls to enhance income or consider dividend-growth peers. |

| Thematic Investors (AI Infrastructure) | ★★★★★ | Core holding; pair strategically with AVGO, AMD, and AI-focused ETFs such as Global X Robotics & AI ETF (BOTZ), VanEck Semiconductor ETF (SMH), and iShares Semiconductor ETF (SOXX). |

Valuation Takeaways:

Fair value range: $125-140 (accounting for competitive pressures)

Momentum target: $170-185 (if AI narrative accelerates beyond current projections)

Support levels: $120, then $95

Timeline: 6-12 months for major catalysts

Our Call: Hold + Trim over $160. NVIDIA’s AI dominance is real, but at $158 you’re paying peak prices for a company facing its first serious competitive challenges in years. The supply chain data validates exceptional execution, but AMD’s MI300X momentum and Broadcom’s infrastructure stranglehold suggest the AI value pool is bigger and more contested than NVIDIA’s valuation implies. While everyone debates NVIDIA vs. AMD, AVGO quietly captures 20% of every AI dollar spent and trades at a discount to its growth and strategic positioning.

We are trimming NVIDIA positions above $160 and rotating into undervalued AI infrastructure plays. Sometimes the best way to profit from an empire is to own the roads, not just the emperor. Alternatively, wait for a pullback to $125-130 for better risk/reward, or consider longer-dated options strategies to benefit from volatility around the GB300 launch in late 2025.