Recent Earnings Update

Adobe Inc. (NASDAQ: ADBE) reported strong second-quarter fiscal 2025 results on June 12, 2025, highlighting significant AI-driven growth despite investor skepticism about monetization.

Q2 Highlights:

- Revenue: $5.87 billion (+11% YoY).

- Non-GAAP EPS: $5.06, exceeding consensus estimate ($4.97).

- Digital Media Revenue: $4.35 billion (+11% YoY), boosted by Creative Cloud and Acrobat.

- Digital Experience Revenue: $1.46 billion (+10% YoY), driven by Adobe Experience Platform and AI features.

- Operating Cash Flow: $2.19 billion; Remaining Performance Obligations (RPO) increased 10% YoY to $19.69 billion.

- Updated Guidance: FY2025 revenue now expected at $23.5–23.6 billion, non-GAAP EPS between $20.50–20.70 (previously $19.50–19.70).

Adobe continues to emphasize AI as a primary growth driver, making significant strides despite short-term investor concerns over AI monetization.

AI Integration and Growth Drivers

Adobe’s comprehensive AI strategy revolves around its Firefly generative AI platform, significantly impacting business performance:

- Firefly Usage: Over 24 billion cumulative assets created, with users generating more than 1 billion assets monthly. Platform traffic grew 30% QoQ, and paid subscriptions nearly doubled.

- Product Adoption: Photoshop’s Generative Fill reached 35% user adoption, Lightroom’s Generative Remove hit 30% monthly active user adoption, highlighting effective AI integration.

- Revenue Contribution: AI-first products launched within the past 24 months have generated over $125 million in Annual Recurring Revenue (ARR), expected to double by fiscal year-end.

- Customer Growth: Over 35,000 new businesses, including Microsoft, ServiceNow, Workday, and Intuit, joined in Q2 2025. Adobe Express alone added ~8,000 new businesses, up 6x YoY.

Competitive Landscape

Adobe maintains a leading market position (~70% share / ~90% among 20 million creative professionals) but faces substantial competition:

- Canva: Dominates consumer market (~90% share of 800 million users) with accessible, AI-enhanced tools.

- Microsoft Corp. (NASDAQ: MSFT): Aggressive expansion into creative and productivity markets via OpenAI partnership.

- Figma (filed for IPO): Holds 80–85% UX/UI market share, critical for collaborative design.

- Bria, Runway ML: Niche competitors with specialized AI capabilities for video and advertising graphics.

Adobe’s strategic differentiation includes commercially safe AI data licensing and compensation of creative professionals.

Detailed Peer Comparison

| Company | Market Cap | Forward P/E | EV/EBITDA | Key Strengths & Differentiators | Major AI Initiatives |

|---|---|---|---|---|---|

| Adobe Inc. (NASDAQ: ADBE) | $176B | ~26x | ~19x | Integrated creative ecosystem, commercially safe AI, strong cash flow | Firefly AI, GenStudio |

| Microsoft Corp. (NASDAQ: MSFT) | $2.3T | ~23x | ~18x | Extensive enterprise presence, productivity integration | Copilot AI, OpenAI integration |

| Canva (Private) | $32B | N/A | N/A | User-friendly, accessible tools, rapid user growth | Leonardo AI integration |

| Figma (filed for IPO) | $20B | N/A | N/A | Dominant UI/UX collaboration, real-time cloud design | Pending integration with Firefly |

| Bria (Private) | N/A | N/A | N/A | Cost-effective high-volume graphic generation | Customizable AI models |

| Runway ML (Private) | N/A | N/A | N/A | Advanced AI video editing capabilities | GenAI video creation |

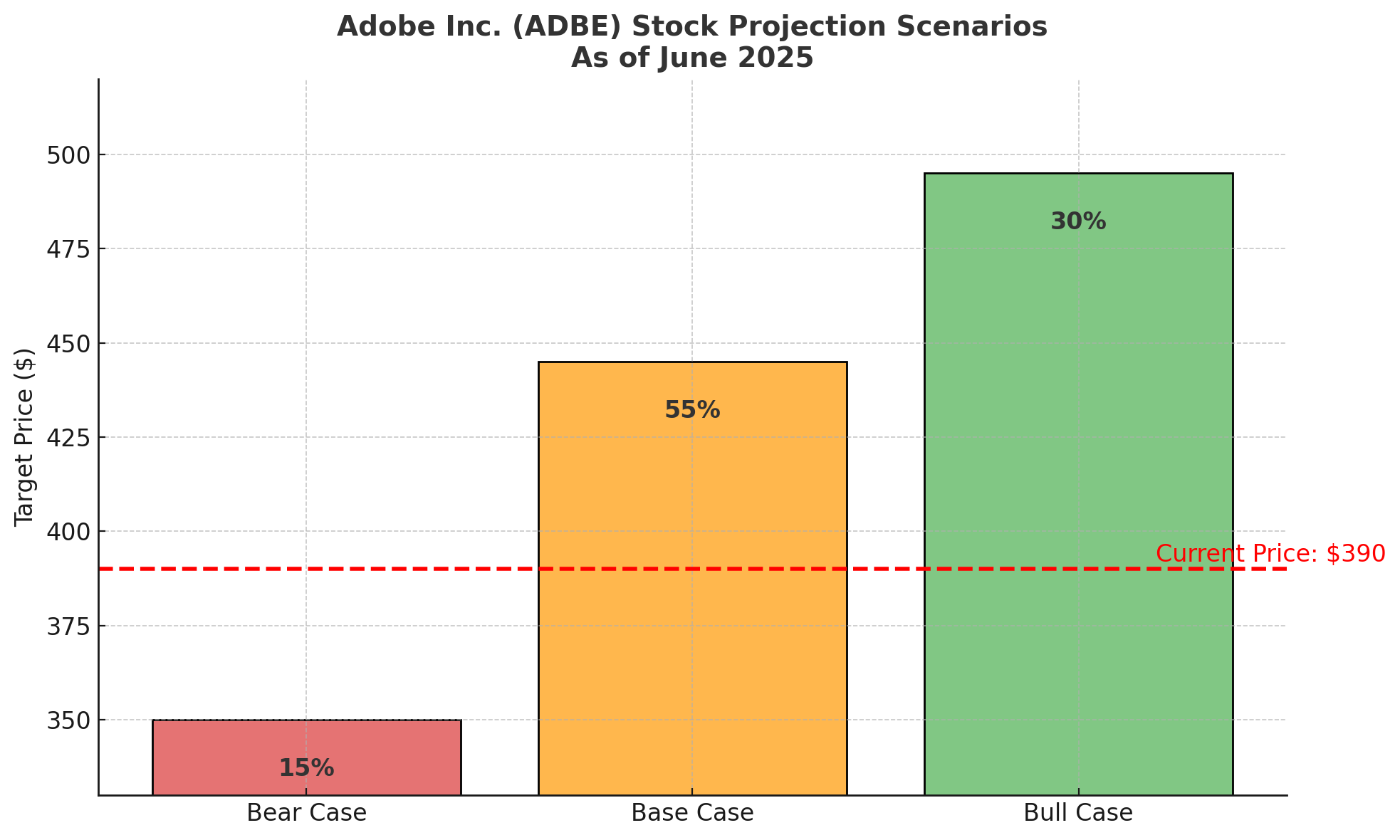

Investment Scenarios & Stock Probability Map (Current Price: $390)

| Scenario | Probability | Price Target | Upside/Downside |

| Base Case | 55% | $430–$460 | +10% to +18% |

| Moderate adoption of Firefly AI, solid enterprise retention, monetization offsetting margin pressures. | |||

| Bull Case | 30% | $480–$510 | +23% to +31% |

| Accelerated AI integration and monetization significantly expand ARR and margins, enhanced competitive advantage. | |||

| Bear Case | 15% | $340–$360 | -8% to -13% |

| Intensified competition, slower AI monetization, higher churn, increased costs, margin pressure. |

Investor Fit Matrix

| Investor Type | Fit Level | Commentary & Strategic Ideas |

| Growth Investors | ★★★ | Comprehensive AI-driven growth. Accumulate strategically around major announcements. |

| Value Investors | ★★★ | Attractive valuation (~16x FY26 EPS). Protective puts to hedge risks advised. |

| Income Investors | ★★ | Limited dividend appeal. Covered calls to enhance yields recommended. |

| Thematic Investors (AI & Creative) | ★★★★ | Strong alignment with AI innovation. Prominent positioning alongside thematic ETFs (e.g., Global X AI ETF – NASDAQ: AIQ). |

Strategic Outlook & Future Prospects

Adobe targets $250 million ARR from AI-first products by FY2025 end, focusing on expanding Firefly’s video, audio, and 3D capabilities. Strategic risks include AI disrupting traditional licensing models and growing competitive pressures. Long-term growth relies on monetization beyond current subscription models.

Long-term Investment Thesis

Adobe is fundamentally reshaping the creative economy with AI at the core of its platform – not as a gimmick, but as a monetizable, enterprise-grade engine. While the market questions AI payoffs, Adobe is already delivering: over $125M in AI-first ARR, 24B assets generated via Firefly, and deep integrations that boost stickiness and pricing power.

What sets it apart? Commercially safe AI with IP indemnification – a must-have for Fortune 500s. Add in Creative Cloud Pro, GenStudio, and Acrobat AI Assistant, and Adobe is expanding beyond creatives into enterprise content ops. Growth isn’t just coming from designers anymore, it’s coming from marketers, SMBs, and students moving up the funnel.

With $2.2B in quarterly cash flow and gross margins near 88%, Adobe has the firepower to keep building. Trading at ~16x FY26 EPS, the stock reflects risk but not the upside of a business reinventing how content is created and monetized.

Our Call: Adobe remains significantly undervalued at current valuations (~16x FY26 EPS). Strong AI adoption, industry leadership, and strong cash generation support a BUY recommendation with a $450 price target (20x FY26 EPS).