Strategic & Market Outlook

Amazon (AMZN), is proactively responding to significant U.S. tariffs imposed on Chinese imports, particularly affecting the electronics and consumer goods sectors. Amazon’s strategy emphasizes diversification of global logistics and fulfillment capabilities. By investing heavily in regional fulfillment centers in Vietnam, India, and Mexico, Amazon enables merchants to lower tariff burdens and mitigate disruptions from geopolitical tensions. Notably, Amazon has absorbed a meaningful portion of increased shipping and import costs, maintaining competitive marketplace pricing and customer loyalty despite rising operational pressures. Amazon’s proactive strategies also include tariff engineering, enhancing its competitive positioning and resilience.

Competitor Shopify (SHOP) is actively expanding its U.S.-focused logistics network, enhancing its capacity to offer tariff-resilient supply chain options. Shopify primarily focuses on fulfillment localized within the U.S., distinguishing itself from Amazon’s more global logistics model.

Amazon’s investment in alternative manufacturing hubs exemplifies strategic agility in anticipating and managing geopolitical risks, positioning itself advantageously as companies increasingly seek to shift away from China-centric production.

Financial Impact and Pricing Pressure

Due to tariffs, consumers purchasing goods through Amazon’s marketplace may see price increases ranging from 10% to 15%. Amazon strategically leverages its supplier relationships, negotiating cost-sharing agreements to partially offset these increases. Moreover, through targeted tariff engineering and diversification of sourcing locations, Amazon aims to mitigate the broader inflationary impact, particularly on electronics and technology goods, which are heavily tariffed and sensitive to price fluctuations.

Peer Comparisons

| Company | Strengths | Weaknesses | Amazon Comparison |

|---|---|---|---|

| Shopify NYSE: SHOP | Extensive U.S. fulfillment network, targeted domestic strategy | Limited global fulfillment capability | Amazon offers superior global logistics reach and cost absorption advantages. |

| Walmart NYSE: WMT | Extensive physical retail network, large-scale sourcing power | High dependency on low-cost Chinese imports | Amazon’s flexible logistics model offers stronger tariff mitigation. |

| Best Buy NYSE: BBY | Strong market presence in electronics retail | Vulnerability to electronics tariff hikes | Amazon’s diversified global logistics significantly mitigates tariff impacts compared to Best Buy. |

| Target NYSE: TGT | Broad consumer base, diversified retail product mix | Exposure to consumer goods tariff pressures | Amazon’s strategic tariff management provides stronger consumer price stability. |

| eBay NASDAQ: EBAY | Established online marketplace, flexible seller base | Limited control over fulfillment costs and logistics | Amazon’s strategic investments in fulfillment and logistics infrastructure offer a distinct competitive edge. |

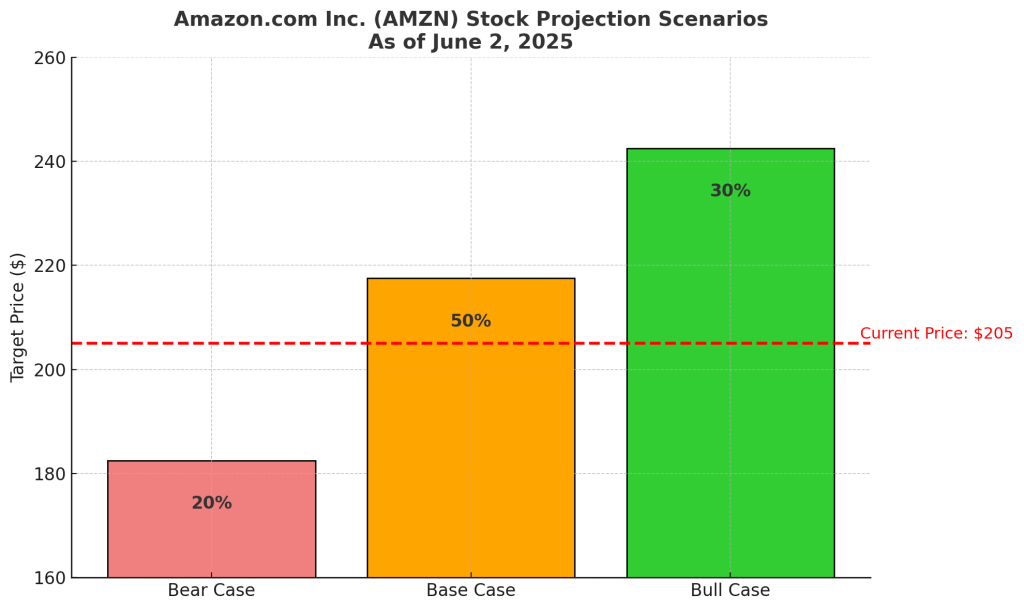

Investment Scenarios & Stock Probability Map

| Scenario | Probability | Price Target |

| Base Case Moderate logistics management with steady marketplace growth. Amazon’s partial absorption of shipping costs helps stabilize competitive positioning despite moderate tariff pressures. | 50% | $210–$225 |

| Bull Case Significant success in logistics diversification and strategic absorption of increased shipping costs leads to heightened competitive advantages, increased market share, and strong consumer retention amid ongoing tariff pressures. | 30% | $235–$250 |

| Bear Case Heightened geopolitical and tariff challenges overwhelm Amazon’s cost absorption strategies, resulting in substantial price increases, declining consumer demand, and slowed revenue growth. | 20% | $175–$190 |

Investor Fit Matrix

| Investor Type | Fit Level | Commentary & Strategic Ideas |

| Growth Investors | ★★★ | Amazon’s strategic logistics initiatives provide significant growth potential. Recommend establishing a core stock position, complemented with call options timed around key tariff negotiations or earnings announcements. |

| Value Investors | ★★☆ | Tariff-induced price pressures offer attractive entry points. Accumulate shares on price dips and use protective put options to hedge against prolonged downside risk. |

| Income Investors | ★★☆ | Limited dividend appeal. Income investors might consider covered call strategies on existing stock positions to enhance income or seek alternatives in dividend-rich logistics firms. |

| Thematic Investors (Logistics & Reshoring) | ★★★ | Strong thematic alignment with global reshoring and logistics diversification trends. Recommend prominent positioning of Amazon within thematic portfolios, complemented by related sector ETFs like iShares U.S. Transportation ETF (IYT) or specific logistic-tech stocks. |

Final Take & Our Call

Amazon’s swift and rounded response to tariff and logistics challenges demonstrates strategic foresight and resilience. While near-term pricing pressures exist, Amazon’s strategic cost absorption and supply chain agility make it a compelling long-term investment. We advocate opportunistic accumulation of shares during market volatility, viewing the company as a resilient and essential holding amid shifting global trade dynamics.