Key Takeaways

Elastic (NYSE: ESTC) continues to reinforce its dominance in the enterprise search and GenAI markets through significant cloud revenue growth, impactful partnerships, and consistent innovation. Fiscal 2025 marked solid operational achievements, though cautious FY2026 guidance reflects prudent management amid macroeconomic uncertainties. Elastic’s technical strengths and strategic partnerships effectively mitigate competitive pressures, especially in consumer-centric segments.

Latest Financial Performance

Elastic reported strong Q4 FY2025 results, with revenue growing 16% YoY to $388 million, driven primarily by a notable 23% rise in Elastic Cloud revenue ($182 million). Non-GAAP operating margins remained consistent at 15%, while diluted EPS of $0.47 comfortably exceeded market estimates by $0.10. These outcomes reflect efficient execution, reinforcing investor confidence in Elastic’s cloud-focused growth strategy and profitability, even amid macroeconomic uncertainty.

For the full fiscal year 2025, Elastic achieved total revenues of $1.483 billion, representing a 17% YoY increase, significantly boosted by a significant 26% growth in Elastic Cloud revenues ($688 million). Stable operating margins paired with solid EPS of $2.04 demonstrate disciplined financial management and effective scalability. Enhanced by additional performance metrics such as an 18% increase in current remaining performance obligations (CRPO) and a 27% rise in large customers ($1M+ ACV), these results further validate Elastic’s strategic positioning, providing a reliable platform for future investment and continued valuation growth (current P/S ~5x).

Growth Drivers:

- Generative AI & Vector Search: Leadership in GenAI and vector databases continues to drive significant customer engagement and revenue growth.

- Strategic Partnerships: Strengthened collaborations with AWS (NASDAQ: AMZN) and Google Cloud (NASDAQ: GOOG, GOOGL) provide strategic market reach and advanced integration capabilities.

- Product Innovation: Continuous advancements such as Binary Quantization (BBQ) maintain Elastic’s technical edge in managing complex data.

Competitive Advantages:

- Open-Source Foundation: Strong developer affinity creates significant switching costs.

- Comprehensive Elastic Stack: Versatile, scalable solutions effectively meet complex enterprise requirements.

- Established Partner Ecosystem: Strategic alliances amplify market presence and technological depth.

Industry and Peer Analysis:

| Company | Strengths | Weaknesses | Elastic Comparison |

|---|---|---|---|

| Cisco / Splunk (NASDAQ: CSCO) | Mature security and observability integrations | Complex, costly solutions | Elastic offers more cost-effective and flexible solutions, though displacing Splunk is challenging |

| Datadog (NASDAQ: DDOG) | Strong SaaS observability solutions | Limited search and security capabilities | Elastic provides broader, flexible solutions suited for advanced search and security use cases |

| Grafana Labs | Intuitive mid-market solutions | Less mature enterprise features | Elastic has superior enterprise-scale and broader application versatility |

| Dynatrace (NYSE: DT) | Strong in application performance monitoring | Limited broader observability and security capabilities | Elastic excels in comprehensive observability and integrated security solutions |

| Coveo (TSX: CVO) | Strong presence in e-commerce, AI-driven search capabilities | Limited scalability for enterprise-wide, complex observability and security needs | Elastic’s comprehensive solution suite offers greater scalability and versatility for complex enterprise deployments |

Weaknesses and Specific Challenges:

- Intense competition from targeted, simplified platforms like Splunk, Datadog, Grafana Labs, and Dynatrace.

- Budget constraints and staffing issues within the U.S. public sector pose risks of prolonged sales cycles and delayed revenue realization.

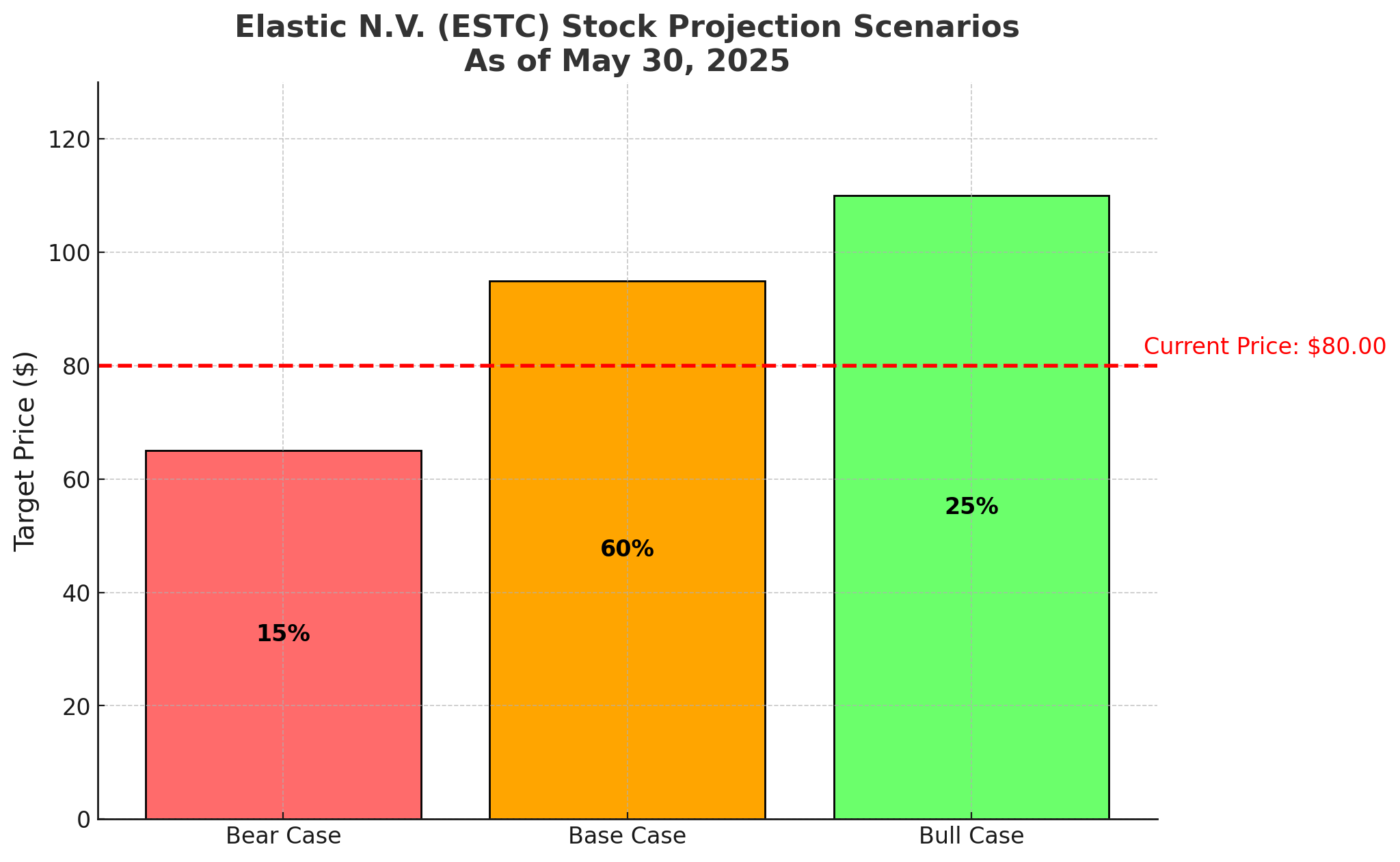

Investment Scenarios & Stock Probability Map

| Scenario | Probability | Price Target |

| Base Case Stable growth, moderate economic conditions, effective competitive positioning | 60% | $95 |

| Bull Case Accelerated GenAI adoption, significant market penetration via partnerships | 25% | $110 |

| Bear Case Prolonged macroeconomic downturn, slow cloud and GenAI adoption rates | 15% | $65 |

Current Price (May 30 2025): $80

Investor Fit Matrix:

| Investor Type | Fit Level | Commentary & Strategic Ideas |

|---|

| Growth Investors | ★★★ | Strong alignment with Elastic’s growth potential. Consider building a core long-term stock position, supplemented by short-term call options around earnings releases to capitalize on volatility and growth momentum. |

| Value Investors | ★★☆ | Moderately attractive with a P/S ratio ~5x. Initiate cautious accumulation of shares during periods of price weakness. Implement protective puts to hedge against macroeconomic risks and downside volatility. |

| Income Investors | ★☆☆ | Limited appeal due to absence of dividends. Income-oriented investors should look at covered call strategies on existing stock positions to generate income, or consider reallocating capital to dividend-paying alternatives. |

| Thematic Investors (AI & Digital Transformation) | ★★★ | Excellent thematic fit. Position Elastic as a cornerstone holding in an AI & Digital Transformation-focused portfolio, complemented by sector ETFs or peer stocks to diversify exposure. Consider periodic rebalancing to maintain thematic consistency. |

Investment Opportunities:

- Cloud Adoption Monitoring: Track market penetration within cloud ecosystems, especially AWS and Google Cloud partnerships.

- GenAI Expansion: Evaluate GenAI customer acquisition trends and market acceptance of Elastic’s advanced search capabilities.

- Public Sector Dynamics: Assess Elastic’s strategic responses to U.S. public sector constraints and identify potential revenue drivers.

- Product Innovation Pipeline: Continuously evaluate innovations (e.g., Binary Quantization) as future revenue growth catalysts.

Our Call: Elastic’s compelling technical strengths and strategic positioning maintain attractive investment potential despite cautious market conditions. Current valuation indicates moderate attractiveness. Strategic accumulation advised especially amid macroeconomic volatility (general market drops), focusing on Elastic’s enduring strengths in AI and cloud-driven enterprise solutions.