Thesis in Brief

ZoomInfo continues to lead the business-to-business (B2B) data intelligence landscape, prized for its data accuracy, Salesforce integration, and sales development representative (SDR) workflow tools. However, competitors are catching up fast, especially in user experience and pricing, while recent declines in mobile number accuracy threaten ZoomInfo’s most important value proposition.

Still a category leader – but in a data arms race that’s growing more crowded, ZoomInfo must lean hard into AI-led data hygiene, strategic pricing, and client education on underused premium features.

Strategic & Market Outlook

B2B Data Intelligence Matures, But So Do Rivals

The B2B intelligence market is moving from raw lead sourcing into insight-driven targeting platforms. ZoomInfo’s Go-To-Market (GTM) Studio, which merges first-party and third-party intent signals, is positioned to serve that evolution – but customer adoption remains low.

AI Is Now a Must-Have, Not a Gimmick

Field investigation emphasizes a key opportunity: enabling users to “interrogate the data like an LLM”, akin to ChatGPT. ZoomInfo’s data lake is massive, and if wrapped in natural language models, could become a strategic edge. However, other players may develop similar capabilities.

Budget Cuts and Commodification Threaten Stickiness

ZoomInfo faces near-term pressure as marketing and sales tech budgets tighten, particularly among mid-market and tech-focused clients. According to Gartner’s 2024 CMO Spend Survey, average marketing budgets fell to 7.7% of company revenue, down from 9.5% in 2022. This mirrors broader trends where CFOs are consolidating spend and prioritizing tools with direct, measurable revenue impact. Within this context, ZoomInfo risks being viewed as a premium, “nice-to-have” layer—especially if underutilized modules like GTM Studio or Copilot aren’t fully embedded into client workflows. Further, as basic contact and firmographic data becomes increasingly commoditized, customers may question whether the incremental value justifies enterprise-level pricing.

Acquisition Potential

The field investigation found inorganic growth as a viable path: acquiring adjacent tools or platforms could let ZoomInfo offer bundled services that enhance lock-in and margin capture. Possible targets: enrichment APIs, generative content tools, and workflow orchestration platforms.

Long-Term Tailwinds

- Shift to digital-first B2B sales

- Account-based marketing (ABM) growth

- Privacy-compliant intent data solutions

- AI-powered sales orchestration tools

Headwinds

- Mobile number accuracy deterioration (~15–30%) since early 2025

- UI/UX edge slipping to leaner, newer competitors

- Price sensitivity among small-to-mid-market (SMB) clients

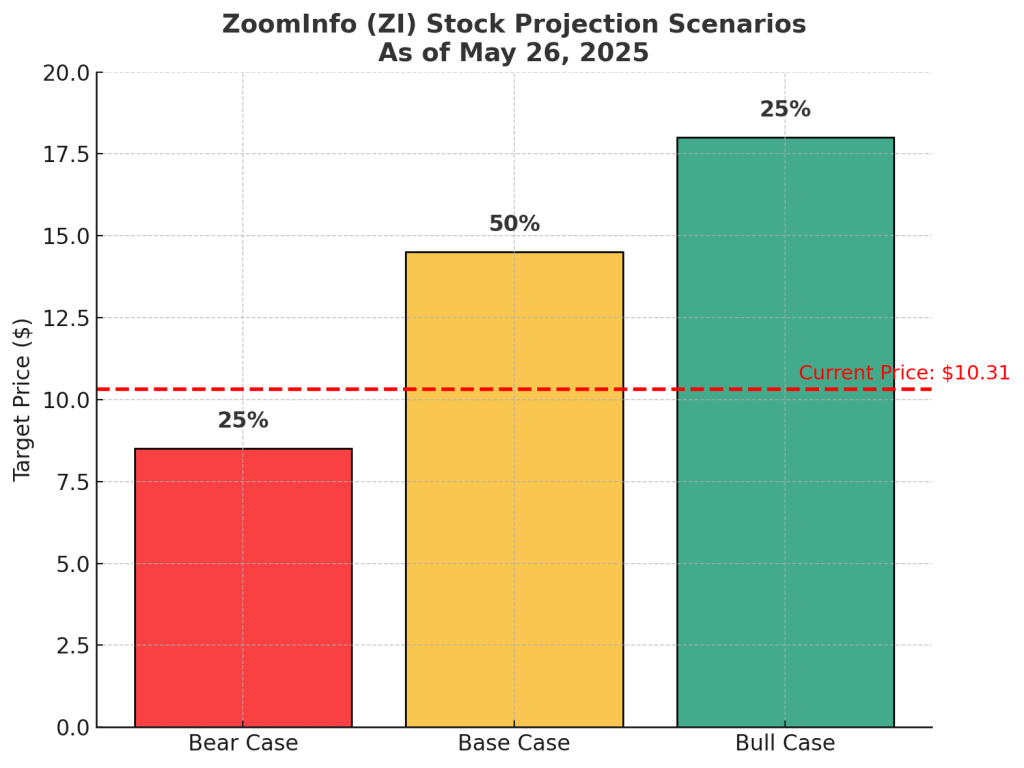

Investment Scenarios & Stock Probability Map

| Scenario | Description | Probability | Price Target |

|---|---|---|---|

| Base Case | AI improves usability; renewals stable in enterprise and mid-market | 50% | $14.50 |

| Bull Case | GTM Studio adoption + strategic M&A boosts cross-sell and retention | 25% | $18.00 |

| Bear Case | Churn from declining data quality and commoditization pressures | 25% | $8.50 |

Current Price: $10.31 (as of May 26, 2025)

Investor Fit Matrix (with Strategic Positioning)

| Investor Type | Fit Level | Commentary |

|---|---|---|

| Growth-Oriented | ★★☆ | Modest fit. Consider pairing with high-growth infrastructure SaaS (e.g. SNOW, MDB) to offset ZI’s execution risk. |

| Deep Value | ★☆☆ | Limited appeal today – trades below peak, but still not “cheap” by Free Cash Flow (FCF) standards. Could be hedged by shorting overvalued SaaS peers if betting on sector re-rating. |

| Momentum Trader | ☆☆☆ | No entry signal yet. Traders could use options spreads (verticals, diagonals, calendar) to speculate on volatility around earnings. |

| Risk-Off/Income Seeker | ☆☆☆ | Not a match. Investors seeking exposure to data trends could use covered calls or hedge with bond proxies like MSFT. |

| AI/Automation Thematic | ★★☆ | Niche fit. Hedge concentration risk by balancing with AI infrastructure names (e.g. NVDA, PLTR). |

| Productivity Stack Strategist | ★★☆ | Strategic position within a broader GTM/RevOps basket. Pair with CRM, HUBS for a multi-layer SaaS thesis. |

Peer Comparison

| Company | Strengths | Weaknesses |

|---|---|---|

| ZoomInfo Technologies Inc. NASDAQ: ZI | Best-in-class enrichment, GTM vision, broad usage | Accuracy degradation, mid-market churn |

| Lusha Ltd. Private | Low-friction UI, Chrome-based simplicity | Poor data scalability, weak enterprise fit |

| Apollo.io Private | Competitive pricing, high data volume | Less mature enrichment/intelligence layer |

| UpLead Private | Transparent pricing, no contracts | No deep CRM or ABM tools |

| LinkedIn (Microsoft Corp.) NASDAQ: MSFT | Massive reach, Sales Navigator integration | Limited enrichment tools; not purpose-built |

| HubSpot Inc. NYSE: HUBS | Native CRM + contact enrichment synergy | Less sophisticated intent segmentation |

| Salesforce Inc. NYSE: CRM | Owns data ecosystem, strong GTM potential | Costly, complex, indirect competition |

Final Take

ZoomInfo’s edge is narrowing, but not erased. It continues to anchor sales tech stacks for demand-gen teams, especially where data accuracy still matters. But leadership will now depend less on historical strength and more on AI-enabled differentiation, aggressive pricing strategy, and improving mobile data reliability. With rivals closing in and budget scrutiny rising, ZoomInfo can no longer afford to coast.

Our call: Hold with bias toward tactical accumulation on general market weakness (price drops). Watch for AI product adoption and net revenue retention in next earnings.